How Fractional Ownership Works in Tokenized Real Estate: Opportunities and Risks Explained

Forget the old-school notion that you need hundreds of thousands to get a seat at the real estate table. Tokenized real estate is flipping the script, letting anyone with a few bucks and an internet connection own a piece of prime property. Fractional ownership, powered by blockchain, is making real estate more accessible, liquid, and transparent than ever before. But before you jump in, let’s break down exactly how this works and what you need to watch out for.

What Is Fractional Ownership in Tokenized Real Estate?

At its core, fractional ownership means multiple investors each own a portion of a physical property, think of it as splitting up a pie instead of eating the whole thing yourself. Blockchain technology takes this further by representing each slice as a digital token. These tokens are securely recorded on-chain, making every transaction visible and verifiable. You can buy, sell, or trade your tokens on specialized platforms, skipping the paperwork and delays that plague traditional real estate deals.

This model has exploded in popularity because it lowers entry barriers. You don’t need $500,000 to buy into a luxury condo; you might only need $500 to grab your first tokenized slice. Platforms like Real Estate Rwas are leading this charge by offering seamless onboarding for both crypto natives and newcomers.

The Opportunities: Why Smart Investors Are Paying Attention

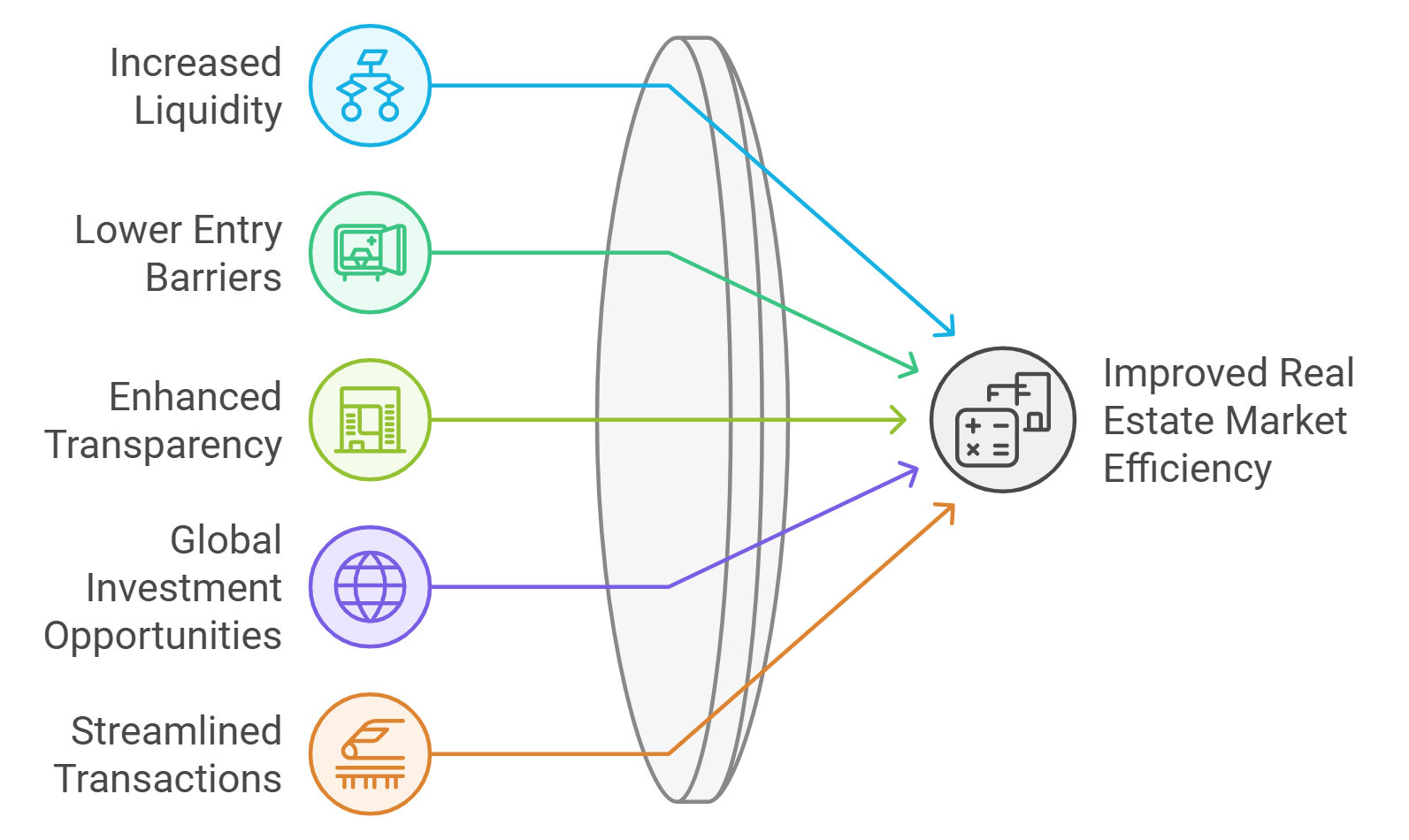

- Lower Entry Barriers: For the first time ever, regular investors can access high-value properties usually reserved for institutions or the ultra-wealthy. You can start small and scale up as you gain confidence.

- Enhanced Liquidity: Unlike traditional property investments that lock up your capital for years, tokenized assets can be traded 24/7 on global exchanges. This means faster exits and more flexibility when market conditions shift.

- Diversification: Spread your risk by owning fractions of multiple properties across different regions or asset types, residential, commercial, industrial, without tying up all your capital in one deal.

- Transparency and Security: Blockchain ensures every transaction is recorded immutably. No more shady backroom deals or lost paperwork; everything is visible to all participants.

If you want to see how fractional real estate ownership works step-by-step using blockchain tokens, check out this deep dive: How Fractional Property Ownership Works with Blockchain Tokens.

The Risks: What Every Investor Needs to Know

No investment is risk-free, and tokenized real estate comes with its own set of pitfalls:

- Regulatory Uncertainty: Laws around digital assets are still evolving. One regulatory change could impact how these platforms operate or even freeze trading temporarily.

- Security Vulnerabilities: Smart contracts are only as good as their code. Bugs or exploits can lead to losses if not properly audited and maintained.

- Market Volatility: While property values tend to be stable long-term, token prices can swing wildly based on demand and platform liquidity, sometimes decoupling from underlying asset values.

- Liquidity Challenges: In theory, tokenization brings instant liquidity, but if there aren’t enough buyers or sellers on the platform yet, it may be tough to cash out quickly at fair value.

If you’re considering diving into this space, make sure you understand both sides of the coin. Conduct thorough due diligence on each platform’s security protocols and regulatory compliance before committing any capital.

The Mechanics: How Does It Actually Work?

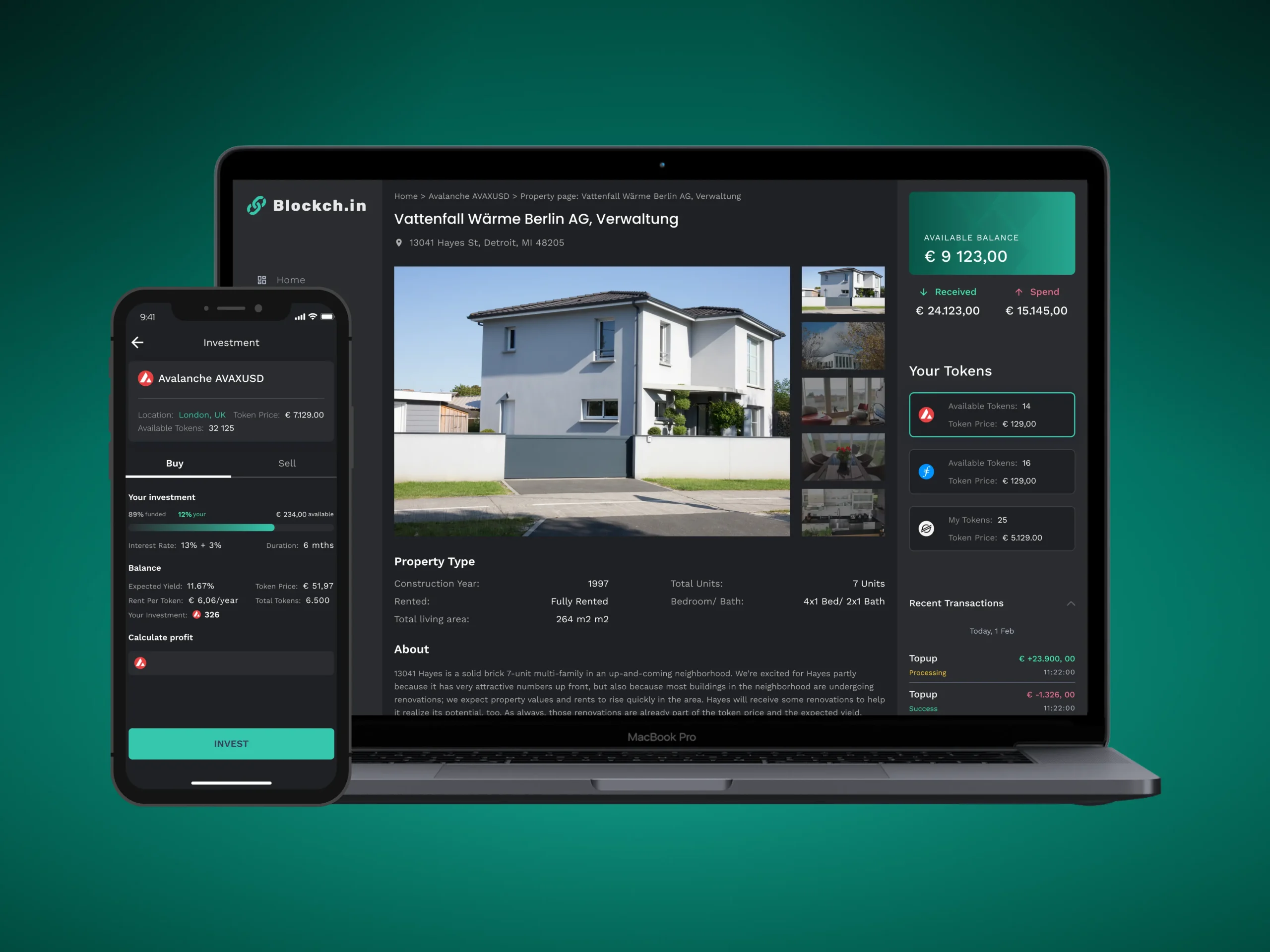

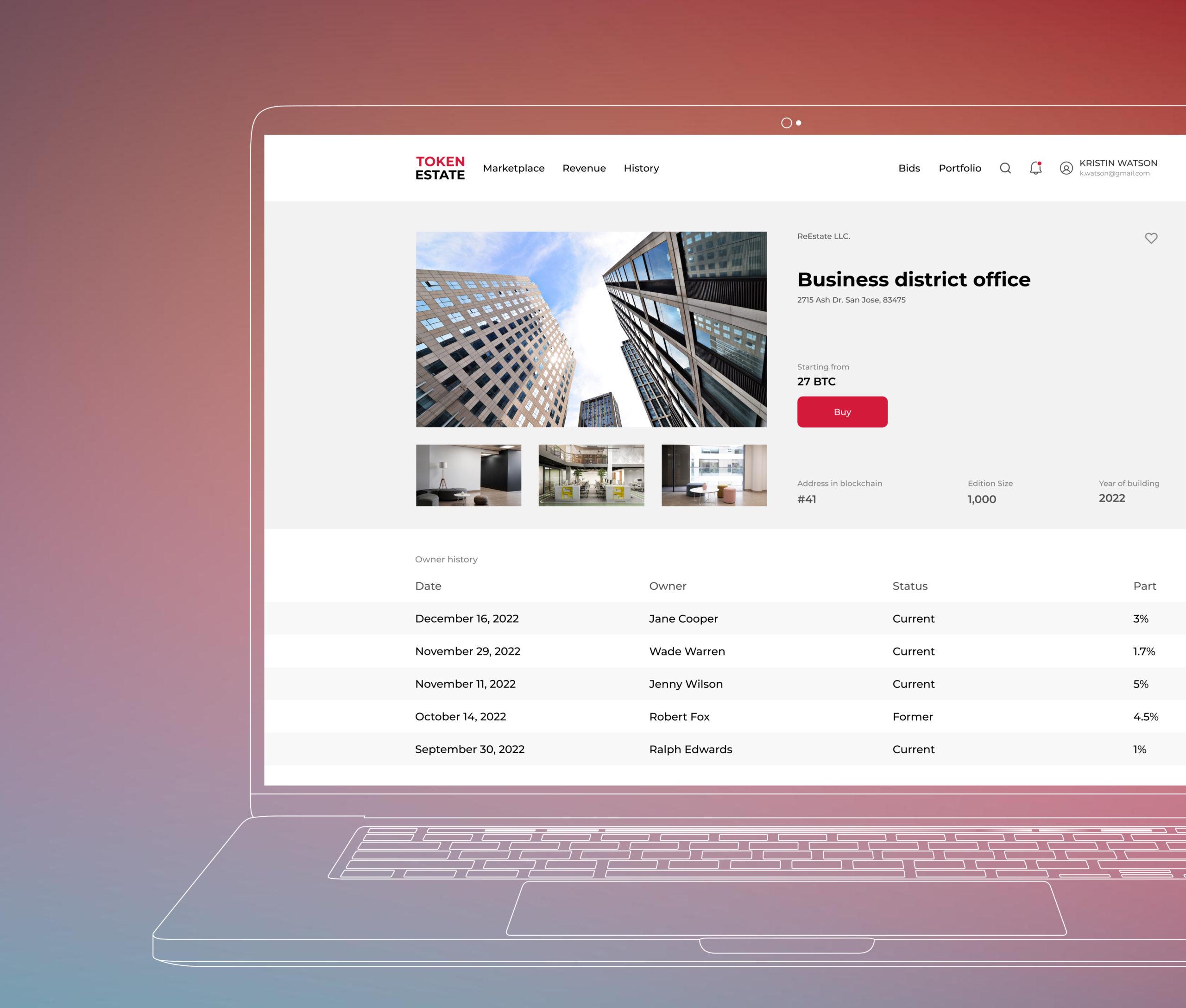

The process starts when a property owner partners with a tokenization platform like Real Estate Rwas or others in the space. The physical asset is legally structured so it can issue digital shares (tokens) through blockchain technology. Each token represents an economic right, a claim on rental income or appreciation, and can be bought in any quantity allowed by the platform’s rules.

Once the property is tokenized, these digital shares become available for purchase on a marketplace. Investors can buy as few or as many tokens as they want, instantly diversifying their portfolios across multiple assets and geographies. The tokens themselves are stored in your digital wallet, no paper deeds, no notaries, just on-chain proof of ownership that’s accessible anytime.

Income distribution is automated: if the property generates rental income or appreciates in value, your share is calculated based on the number of tokens you hold. Smart contracts handle payouts directly to your wallet, cutting out middlemen and reducing costs. For those who want out, selling is as easy as listing your tokens on a secondary market. If there’s demand, you get instant liquidity, something unheard of in traditional real estate.

Step-by-Step: Buying & Selling Fractional Real Estate Tokens

-

1. Choose a Tokenized Real Estate PlatformStart by selecting a reputable platform like RealT, Propy, or Republic Real Estate. These platforms list vetted properties and facilitate tokenized transactions.

-

2. Complete Identity Verification (KYC)Register and undergo KYC (Know Your Customer) checks to comply with regulations. This step ensures secure and legal participation in property token offerings.

-

3. Browse and Select a PropertyExplore available properties, reviewing details like location, rental yield, and token price. Platforms often provide property overviews, financials, and legal documents for due diligence.

-

4. Purchase Fractional TokensDecide how many tokens to buy—each representing a share of the property. Use supported payment methods, such as fiat currency, USDC, or Ethereum, to complete your purchase.

-

5. Receive Tokens in Your Digital WalletAfter purchase, tokens are transferred to your blockchain wallet (e.g., MetaMask or platform wallet), granting you fractional ownership and rights to rental income or capital gains.

-

6. Earn Income and Monitor PerformanceAs a token holder, you may receive rental income distributions and can track property performance via the platform dashboard or blockchain explorers.

-

7. Sell or Trade Your TokensTo exit, list your tokens on the platform’s secondary marketplace or supported exchanges (e.g., OpenFinance). Sell at market price or to a specific buyer, subject to liquidity.

Due Diligence: What to Look for Before You Buy

Don’t let the hype blind you, smart investors know that due diligence is non-negotiable. Here’s what you should be laser-focused on before pulling the trigger:

- Platform Reputation: Has the platform been audited? Are there credible backers? Look for transparent track records and third-party security assessments.

- Legal Structure: Is your ownership legally enforceable? Make sure the token represents a real claim on the underlying property, not just a speculative instrument.

- Liquidity Metrics: Check trading volumes and active user counts. High liquidity means easier entry and exit; low liquidity could trap your capital.

- Regulatory Compliance: Does the platform comply with local and international laws? Regulatory clarity is crucial for long-term stability.

If you want to go deeper into how fractional ownership platforms are making commercial real estate accessible through tokenization, read more at TokenREITs.

Who Wins with Fractional Ownership?

This model isn’t just about democratizing access, it’s about creating new winners in an old game. Small investors can finally participate in high-value deals without being sidelined by institutions. Property owners unlock new pools of capital globally, while platforms earn fees for facilitating trades and managing compliance.

The bottom line: fractional ownership via tokenized real estate isn’t a passing trend, it’s a structural shift that’s already changing how wealth moves around the world. The opportunities are massive if you play it smart, but so are the risks if you go in blind.

If you’re ready to explore further or want to see more examples of how blockchain-enabled fractional ownership works in practice, check out our guide on fractional real estate ownership with blockchain tokenization.