How Blockchain Layer 1s Built for Real Estate Are Transforming Property Tokenization

Blockchain technology has long promised to disrupt traditional real estate, but only in the last few years have we seen the emergence of Layer 1 blockchains purpose-built for real estate. These platforms are not just adapting generic crypto infrastructure; they are engineering solutions tailored to the unique demands of property tokenization, compliance, and on-chain settlement. As a result, real estate investing is entering a new era of accessibility, efficiency, and global reach.

Why Specialized Layer 1s Matter for Real Estate Tokenization

General-purpose blockchains like Ethereum paved the way for tokenized assets, but as real estate tokenization scales, the limitations of these networks, such as high transaction fees, slow settlement, and complex compliance management, have become apparent. Enter real estate-focused Layer 1s: blockchains such as Polymesh, Haven1, Concordium, and Redbelly Network that are engineered from the ground up for asset tokenization and regulatory alignment.

These platforms address critical bottlenecks:

- Native compliance modules that embed KYC/AML directly into token mechanics

- Identity verification layers for trust and regulatory clarity

- Efficient consensus algorithms that enable fast, secure, and low-cost transactions

- Customizable smart contracts for revenue distribution and investor rights

This new breed of Layer 1s is strategically built to support the full lifecycle of property tokenization, from issuance and trading to compliance and settlement. For a deeper dive into fractional ownership mechanics, see our guide on how fractional real estate ownership works with blockchain tokenization.

Pioneers: Polymesh, Haven1, Concordium, and Redbelly Network

The market is witnessing rapid innovation as leading protocols compete to become the backbone of tokenized real estate investing. Let’s break down what sets these platforms apart:

Key Features of Leading Layer 1s in Real Estate Tokenization

-

Polymesh: Purpose-built for asset tokenization, Polymesh offers native features for real estate, such as embedded compliance rules and secure, licensed node operators, enabling seamless and secure property tokenization.

-

Haven1: With a compliance-first architecture, Haven1 is designed for secure RWA tokenization. Its 2025 partnership with Blocksquare integrates advanced tokenization protocols, strengthening regulatory adherence and asset security.

-

Concordium: Concordium integrates zero-knowledge-based identity verification, ensuring regulatory compliance and trust. Its DeFi compatibility supports efficient, secure tokenization and trading of real estate assets.

-

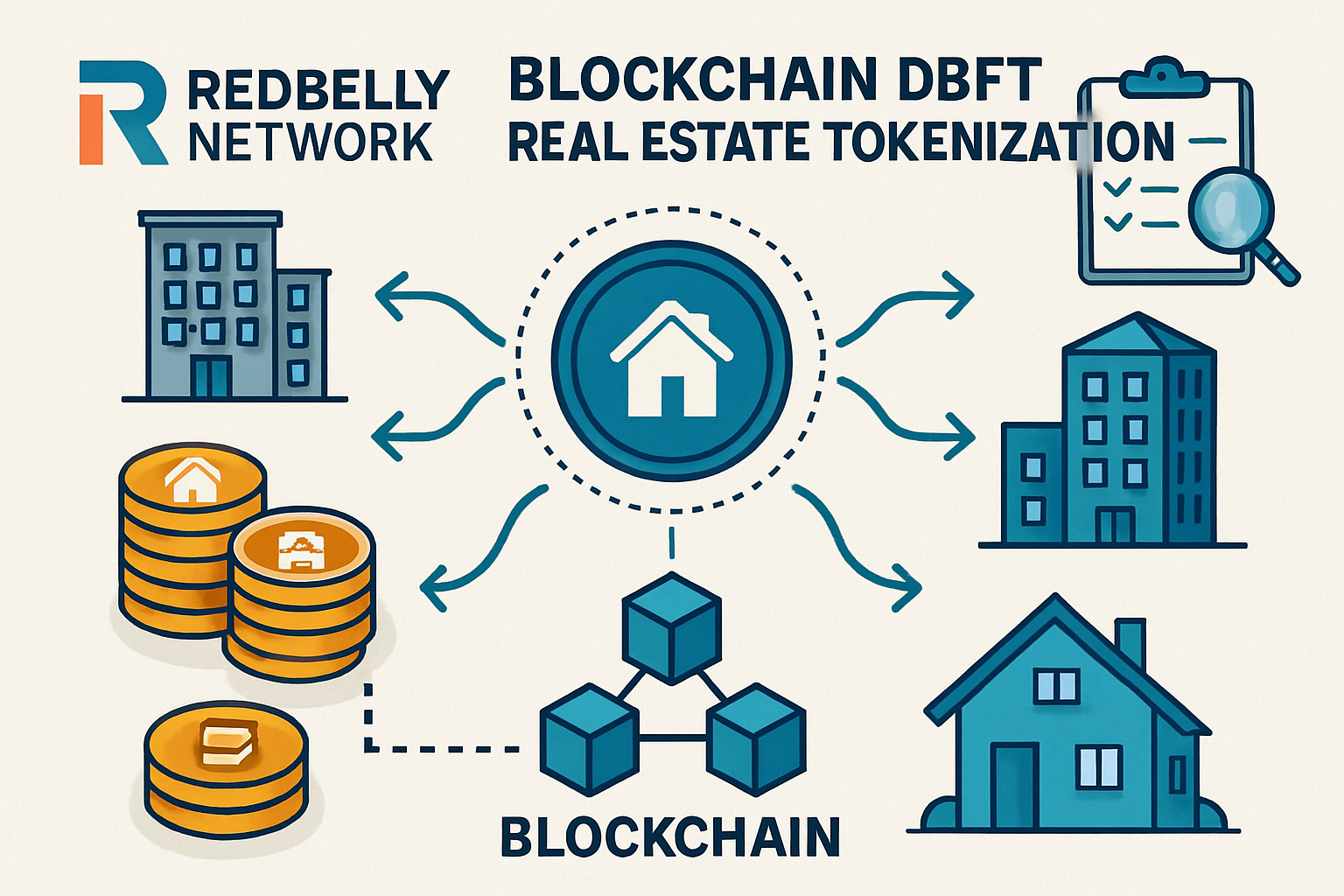

Redbelly Network: Utilizing Deterministic Byzantine Fault Tolerance (DBFT), Redbelly Network prevents forking and double-spending. Mandatory off-chain identity verification aligns with global regulatory standards for property tokenization.

Polymesh stands out with its asset-centric architecture, embedding compliance rules directly into tokens. This means property managers can issue tokens that automatically enforce regulations, no need for complex external smart contracts. Security is prioritized through licensed node operators, reducing counterparty risk.

Haven1 has made headlines with its compliance-first approach. In July 2025, Haven1 announced a strategic partnership with Blocksquare to integrate their tokenization protocol, signaling a major step toward institutional-grade security for on-chain property settlement.

Concordium’s zero-knowledge identity layer is a game-changer for privacy and trust. By integrating identity verification at the protocol level, Concordium streamlines onboarding while maintaining regulatory standards, a must-have for cross-border property deals.

Redbelly Network’s leaderless DBFT consensus mechanism delivers high throughput without sacrificing security. Its requirement for off-chain digital identity verification aligns perfectly with evolving global regulations on real world asset (RWA) tokenization.

The Real-World Impact: Fractional Ownership and Liquidity Redefined

The practical upshot of these innovations is profound: investors can now access fractional shares of high-value properties via blockchain tokens. This lowers entry barriers, think of owning a portion of a landmark building without needing millions in capital, and enables global participation around the clock.

Liquidity is finally coming to one of the world’s most illiquid asset classes. With secondary markets powered by these specialized Layer 1s, investors can buy or sell property tokens in minutes rather than months. The transparency and immutability of blockchain records also slash fraud risk and build trust among stakeholders. For more about how tokenized real estate is changing property investment for crypto enthusiasts, check out our insights here.

Recent Industry Movements: Partnerships and Global Adoption

The momentum behind real estate-focused blockchains is accelerating. In January 2025, Dubai developer DAMAC Group signed a $1 billion deal with MANTRA to tokenize Middle Eastern assets, an unprecedented move that underscores institutional confidence in this technology. Meanwhile, China’s Seazen Group launched its Digital Assets Institute in Hong Kong to convert property holdings into blockchain-traded digital tokens.

Would you invest in tokenized real estate using specialized Layer 1 blockchains?

With platforms like Polymesh, Haven1, Concordium, and Redbelly Network making property tokenization more secure, transparent, and accessible, would you consider investing in real estate through these blockchain-powered solutions?

This wave of adoption signals a strategic shift: major players are betting on blockchain Layer 1s as the foundation for future-proof real estate investment. The next phase? Wider integration with DeFi protocols, automated compliance checks, and seamless cross-border transactions, all underpinned by robust Layer 1 infrastructure designed specifically for property markets.

As these specialized blockchains mature, the ecosystem is rapidly diversifying. We’re seeing tokenization protocols that not only streamline on-chain property settlement but also integrate advanced governance, revenue sharing, and even ESG (Environmental, Social, Governance) tracking directly within smart contracts. This level of programmability is unlocking new investment models and operational efficiencies previously unimaginable in traditional real estate markets.

“Tokenized real estate investing isn’t just about liquidity, it’s about making global participation frictionless and secure. The next decade will see real estate portfolios managed as seamlessly as digital assets. “

Consider the implications for everyday investors: fractional ownership powered by Layer 1s like Polymesh or Concordium means you can diversify across geographies and asset types with a few clicks, no borders, no paperwork headaches. And for institutional players, automated compliance modules and on-chain audits reduce costs while ensuring regulatory alignment across jurisdictions.

What’s Next for Blockchain Layer 1s in Real Estate?

The competitive landscape is heating up as platforms race to offer the most robust real estate tokenization protocols. Expect to see:

Five Key Trends Shaping Blockchain Layer 1s in Real Estate

-

Purpose-Built Compliance and Security: Modern Layer 1 blockchains like Polymesh and Haven1 are designed with compliance and security at their core, embedding regulatory requirements and robust identity verification directly into their infrastructure. This ensures real estate tokenization aligns with global legal standards and builds trust among institutional investors.

-

Integration of Digital Identity Solutions: Platforms such as Concordium and Redbelly Network are leading the way by incorporating advanced digital identity verification, including zero-knowledge proofs and off-chain identity providers. This trend enhances transparency, supports regulatory compliance, and streamlines onboarding for real estate investors.

-

Strategic Partnerships Accelerating Adoption: High-profile collaborations, like the DAMAC Group’s $1 billion partnership with MANTRA and Haven1’s integration with Blocksquare, are driving mainstream adoption of real estate tokenization. These alliances demonstrate confidence in Layer 1 solutions and foster large-scale asset digitization initiatives.

-

Fractional Ownership and Enhanced Liquidity: Layer 1 blockchains are enabling fractionalization of real estate assets, allowing investors to purchase and trade small portions of properties. This democratizes access to property investment and unlocks liquidity in a traditionally illiquid market.

-

Operational Efficiency Through Smart Contracts: The use of native smart contract automation on Layer 1 platforms streamlines processes such as revenue distribution, compliance checks, and transaction settlements. This reduces reliance on intermediaries, cuts costs, and improves transaction speed for all stakeholders.

On-chain property settlement will soon become the industry norm rather than a niche experiment. As security tokens gain traction on regulated exchanges and secondary markets expand, tokenized assets will be priced more transparently, reducing information asymmetry between buyers and sellers.

The integration of DeFi lending protocols with Layer 1 real estate blockchains could also enable novel financing solutions: imagine borrowing against your fraction of a commercial building or instantly refinancing an international property portfolio via smart contracts. This composability is where blockchain-native infrastructure truly shines.

Risks, Regulation, and Strategic Considerations

No discussion would be complete without acknowledging the risks. Regulatory clarity remains a moving target in many jurisdictions; while platforms like Haven1 and Redbelly Network are setting new standards for compliance, investors should perform rigorous due diligence before engaging with any new protocol. Security audits, transparent governance structures, and clear legal frameworks are non-negotiable in this evolving landscape.

For those seeking practical guidance on navigating these emerging markets, and understanding how tokenized assets can solve traditional liquidity challenges, explore our resource on how blockchain tokenization is transforming real estate liquidity for global investors.

A More Accessible Future for Property Investment

The rise of purpose-built Layer 1 blockchains represents a strategic inflection point for both investors and property owners. By lowering barriers to entry and embedding trust at the protocol level, these networks are democratizing access to high-value properties worldwide, and fundamentally reshaping what it means to invest in real estate.

If you’re ready to explore tokenized real estate investing or want to understand how integra layer real estate blockchain solutions could fit into your portfolio strategy, now is the time to engage with this fast-evolving landscape.