How Fractional Real Estate Ownership Works with Blockchain Tokenization

Fractional real estate ownership is experiencing a paradigm shift, powered by blockchain tokenization. Traditional property investment has long been hampered by high entry barriers, illiquidity, and opaque processes. Blockchain is changing this by enabling investors to own, trade, and benefit from fractions of real estate assets, all represented as digital tokens on a secure, transparent ledger. This model is not just theoretical – it is already being deployed by pioneering platforms and is projected to reshape the global real estate investment landscape.

Tokenization: The Engine of Fractional Real Estate Ownership

At the core of this transformation is tokenization. Here, the value of a physical property is divided into digital tokens, each representing a fractional ownership stake. For example, a $1 million property can be split into 1,000 tokens, each worth $1,000. These tokens are securely recorded on a blockchain, ensuring immutable proof of ownership and enabling seamless trading on regulated digital exchanges. The result? Investors can buy, sell, or trade their property fractions with unprecedented speed and efficiency.

“Tokenization is not just about accessibility – it’s about fundamentally redefining how property value is allocated, accessed, and exchanged. “

How Blockchain Makes Fractional Ownership Possible

Blockchain real estate tokenization solves many pain points that have plagued property markets for decades. The blockchain ledger provides transparency and tamper-proof records for every transaction, eliminating disputes over ownership. Smart contracts automate critical processes like income distribution and compliance checks, removing the need for costly intermediaries. This not only reduces transaction costs but also accelerates settlement times from weeks to minutes.

Key Benefits of Tokenized Property Investment

-

Increased Accessibility: Tokenization lowers the investment threshold, allowing global investors to own fractional shares of high-value properties with modest capital outlays. This democratizes access to real estate markets that were previously limited to large investors.

-

Enhanced Liquidity: Digital tokens representing property shares can be traded on regulated secondary markets, enabling investors to buy or sell their positions quickly—unlike traditional real estate, which is typically illiquid.

-

Transparency and Security: Blockchain’s immutable ledger ensures all transactions and ownership records are tamper-proof and easily auditable, reducing fraud risk and increasing investor trust.

-

Automated Income Distribution: Smart contracts facilitate seamless, timely rental income or profit distributions directly to token holders, eliminating manual processes and reducing administrative costs.

-

Global Market Participation: Investors from around the world can participate in property markets outside their home countries, bypassing traditional geographic and regulatory barriers through compliant platforms like RealT and BrickMark.

Platforms like RealT and BrickMark are already proving the viability of this model. RealT allows investors to purchase fractional shares in U. S. rental properties, receiving daily rental income distributed via smart contracts. BrickMark made headlines by tokenizing a portion of Zurich’s Bahnhofstrasse 52 property, marking the largest blockchain-based real estate transaction to date. These examples highlight the growing momentum behind compliant property token trading and the increasing liquidity of previously illiquid real estate assets.

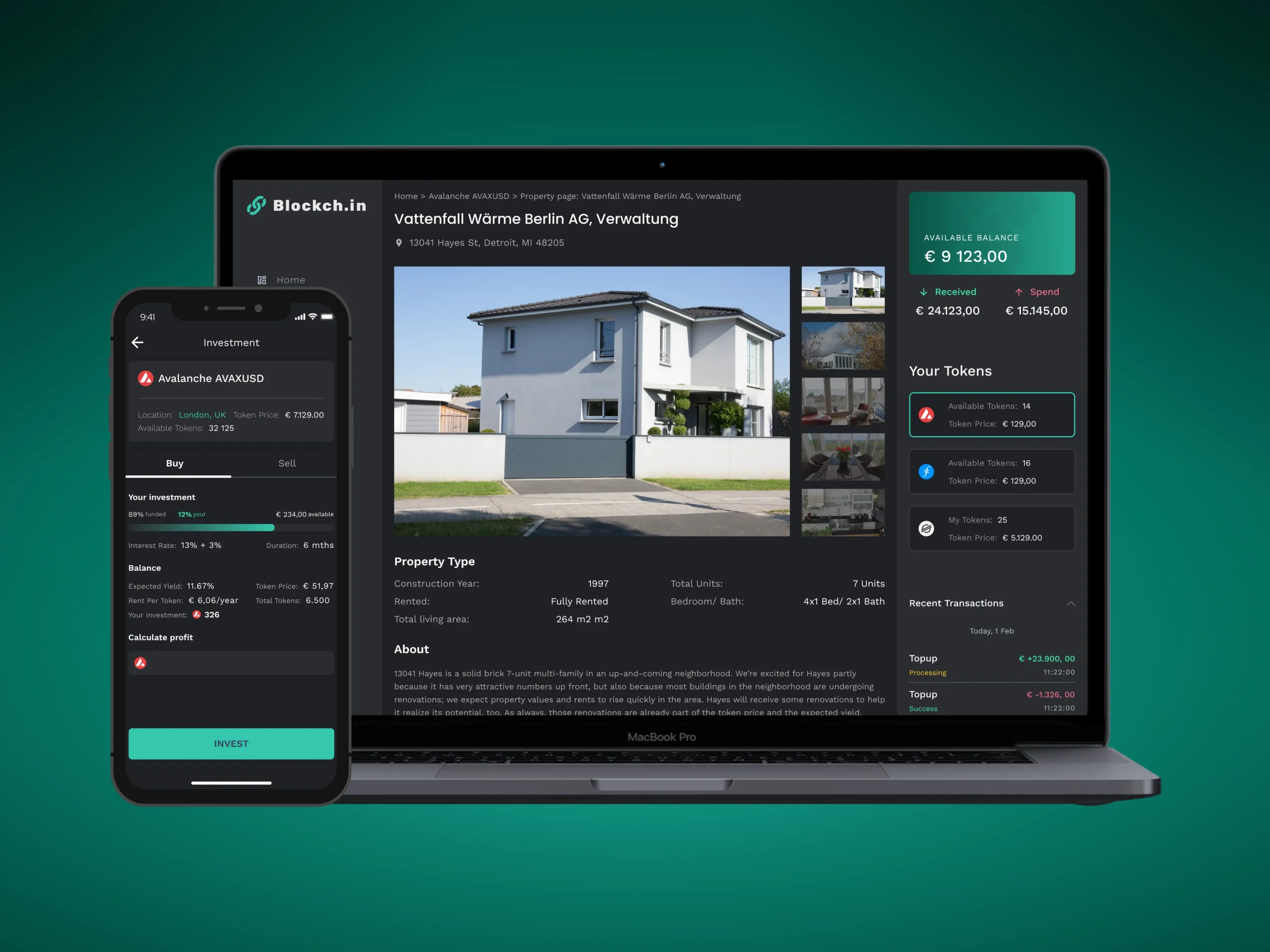

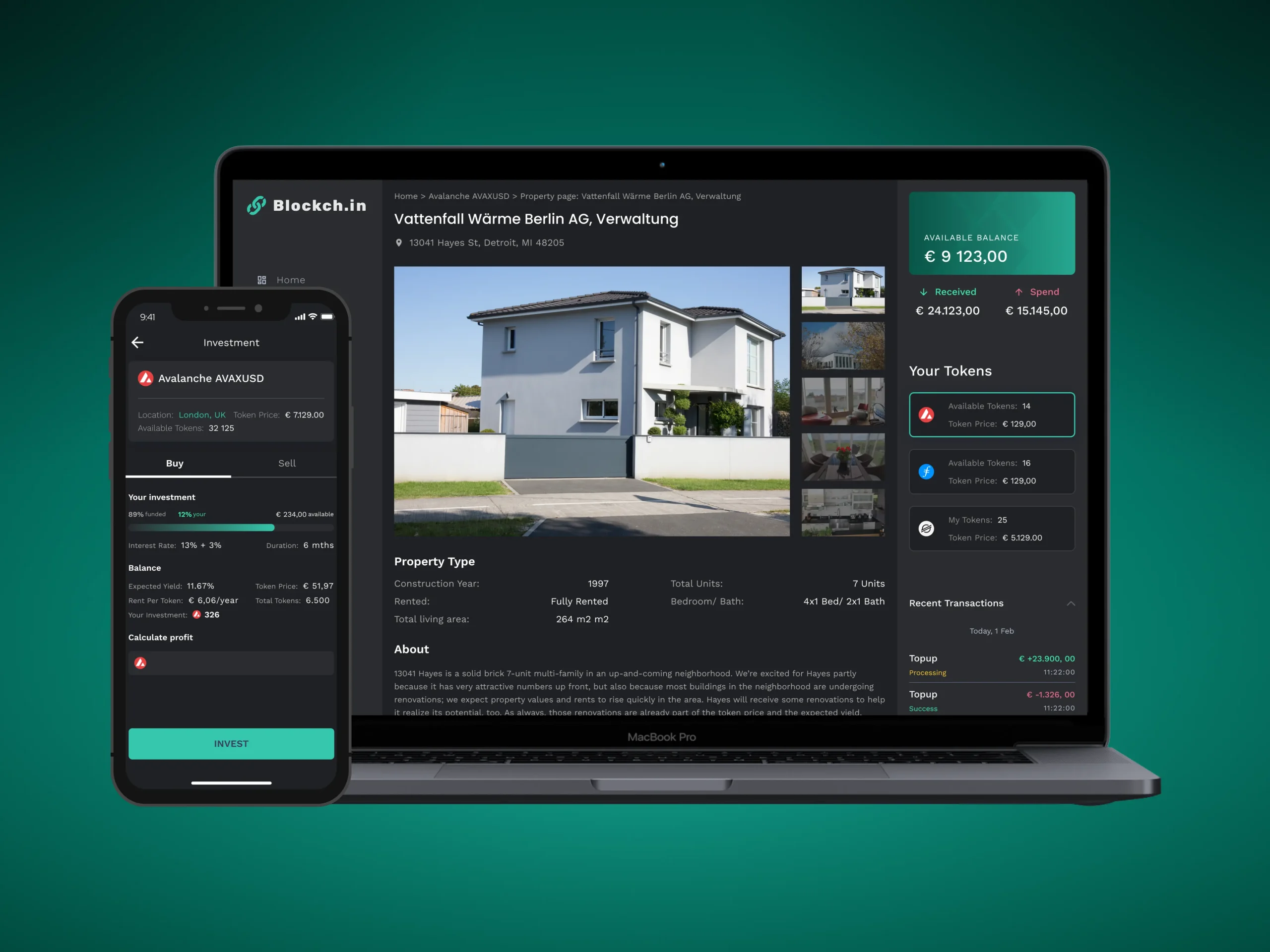

The Mechanics: From Property to Tradable Token

The process of creating tokenized real estate typically follows a clear sequence:

- Property Valuation: A professional appraisal determines the current market value.

- Token Creation: Digital tokens are minted on a blockchain, each representing a slice of the property.

- Fractional Sale: Investors buy tokens, acquiring proportional ownership stakes.

- Trading and Transfers: Tokens can be traded on secondary markets, offering liquidity rarely seen in traditional real estate.

- Income Distribution: Rental income or profits are automatically distributed to token holders via smart contracts.

This structure dramatically lowers the financial threshold for entry and democratizes access to high-value properties. It also facilitates real estate smart contracts that ensure transparent and timely payouts to investors. For a deeper dive into the practicalities and latest use cases, see this detailed guide on how fractional property ownership works with blockchain tokens.

Real-World Adoption and Market Growth

The adoption curve for blockchain real estate tokenization is accelerating. Regulatory-compliant platforms are gaining traction with both retail and institutional investors. For instance, the Dubai Land Department’s pilot for tokenizing title deeds is a signal to global markets that regulatory frameworks are catching up with technology. Projections estimate the tokenized real estate market could surpass $16 billion by 2033, reflecting the sector’s rapid maturation and mainstream appeal.

Yet, despite the surge in adoption, several strategic considerations remain for investors and market participants. Regulatory clarity is still evolving, especially across borders. Platforms operating in the U. S. , such as RealT, are subject to SEC oversight, which provides a degree of investor protection but also introduces compliance complexity. Meanwhile, jurisdictions like Dubai are actively shaping their own frameworks to facilitate tokenized property investment while mitigating risks around money laundering and fraud.

From a macro perspective, the liquidity unlocked by fractional ownership is a game changer. Secondary markets for property tokens mean investors are no longer locked into multi-year holding periods typical of traditional real estate. Instead, they can rebalance portfolios or exit positions quickly, mirroring the flexibility found in equity or bond markets. This shift also attracts a new breed of global investor who values diversification and rapid capital deployment.

Opportunities and Risks: What Investors Need to Know

While the benefits are clear, accessibility, transparency, and efficiency, investors must approach tokenized property with a strategic mindset. Key risks include:

- Regulatory Uncertainty: Legal frameworks may change as governments respond to market innovation.

- Platform Risk: The security and reliability of tokenization platforms vary; due diligence is essential.

- Market Volatility: While liquidity is increasing, secondary markets for property tokens are still maturing and may experience price swings.

- Asset Quality: Not all tokenized properties are created equal; investors should scrutinize underlying asset fundamentals.

For those who navigate these risks thoughtfully, the upside is significant. Tokenized real estate offers exposure to historically resilient assets with the added benefit of blockchain-enabled liquidity. As regulatory structures solidify and institutional capital flows into the space, we can expect further innovation, such as dynamic pricing models for tokens, integration with DeFi protocols, and even cross-border property syndication.

Top Compliant Property Token Trading Platforms

-

RealT — A U.S.-based platform enabling fractional ownership of residential properties through blockchain tokenization. RealT offers SEC-compliant trading, daily rental income distribution, and secondary market liquidity for property tokens.

-

Dubai Land Department — The first government real estate registrar in the UAE to pilot blockchain-based tokenization of property title deeds. This initiative enhances transparency and regulatory compliance for fractional property ownership in Dubai.

-

BrickMark — A Zurich-based firm that executed one of the largest blockchain tokenized real estate deals by acquiring a stake in Bahnhofstrasse 52. BrickMark issues Ethereum-based tokens, enabling compliant fractional investment in prime commercial properties.

-

tZERO — A regulated U.S. platform supporting security token trading, including real estate-backed tokens. tZERO provides a compliant marketplace for secondary trading of tokenized property assets under SEC oversight.

-

INX — A global digital asset trading platform that facilitates compliant trading of tokenized real estate securities. INX operates under regulatory frameworks in the U.S. and internationally, supporting institutional and retail investors.

Ultimately, blockchain real estate tokenization is not merely an incremental improvement, it is an architectural overhaul of how value is stored, transferred, and grown through property. The days when prime real estate was reserved for large institutions or ultra-high-net-worth individuals are fading. With fractional real estate ownership, powered by compliant smart contracts and transparent ledgers, the path is open for anyone with vision, and capital, to participate in one of the world’s most enduring asset classes.