How Fractional Real Estate Ownership via Blockchain is Making Global Property Investment Accessible

Fractional real estate ownership via blockchain is rapidly reshaping the landscape of global property investment. By leveraging blockchain technology, investors can now purchase digital tokens that represent a share in real-world properties, unlocking markets that were previously out of reach for most individuals. This paradigm shift is making it possible for anyone with as little as $50 to gain exposure to high-value real estate assets, bypassing the traditional barriers of capital requirements, paperwork, and geographic limitations.

Tokenized Real Estate: The Mechanics Behind Fractional Ownership

At its core, fractional real estate ownership involves dividing a property into multiple shares or tokens, each representing a proportional stake in the underlying asset. These property tokens are issued and managed on blockchain networks, ensuring transparent, tamper-proof records of ownership. Investors can buy, sell, or trade these tokens on specialized marketplaces, bringing unprecedented liquidity to an asset class that has historically been illiquid and cumbersome to transact.

The process is straightforward yet powerful. When a property is tokenized, its value is converted into a fixed number of digital tokens. Each token grants the holder rights to rental income, appreciation, or other benefits associated with the property. Platforms such as RealT, Propy, and Lofty AI have pioneered this approach:

Key Features of Leading Real Estate Tokenization Platforms

-

RealT: Tokenizes U.S. properties, enabling investors to buy fractional ownership with daily rental income paid in stablecoins. Over 700 properties valued at $130 million have been tokenized, and tokens are tradable on secondary markets for enhanced liquidity.

-

Propy: Offers global tokenization for residential and commercial real estate. Integrates KYC, legal compliance, and smart contract-powered title transfers, streamlining cross-border property transactions and ensuring regulatory adherence.

-

Lofty AI: Built on Algorand, allows fractional investment in income-generating properties starting at $50. Features AI-powered analytics for informed investment decisions and automates income distribution via smart contracts.

-

RedSwan: Specializes in tokenizing prime commercial real estate assets, providing fractional ownership opportunities and increased liquidity for institutional and retail investors.

-

Global Reach and Compliance: Platforms like RealT, Propy, and Lofty AI operate under evolving regulatory frameworks, with jurisdictions like Dubai and the U.S. enabling compliant, cross-border participation in tokenized property markets.

Explore how fractional property ownership works with blockchain tokens.

The 2025 Market: From Niche to Mainstream

The growth trajectory for tokenized real estate has been remarkable. As of September 2025, over $7 billion worth of properties have been tokenized worldwide – a figure projected to soar to $4 trillion by 2035. This surge is not just about numbers; it signals a fundamental transformation in how people perceive and access property investments globally.

Consider recent landmark transactions in Dubai, where luxury properties were sold via blockchain tokens to buyers spanning more than 35 countries. Meanwhile, U. S. -based platforms like Lofty AI and RealT operate under SEC oversight, providing confidence to both retail and accredited investors through rigorous compliance standards.

Pillars of Accessibility: Why Blockchain Property Investment Matters Now

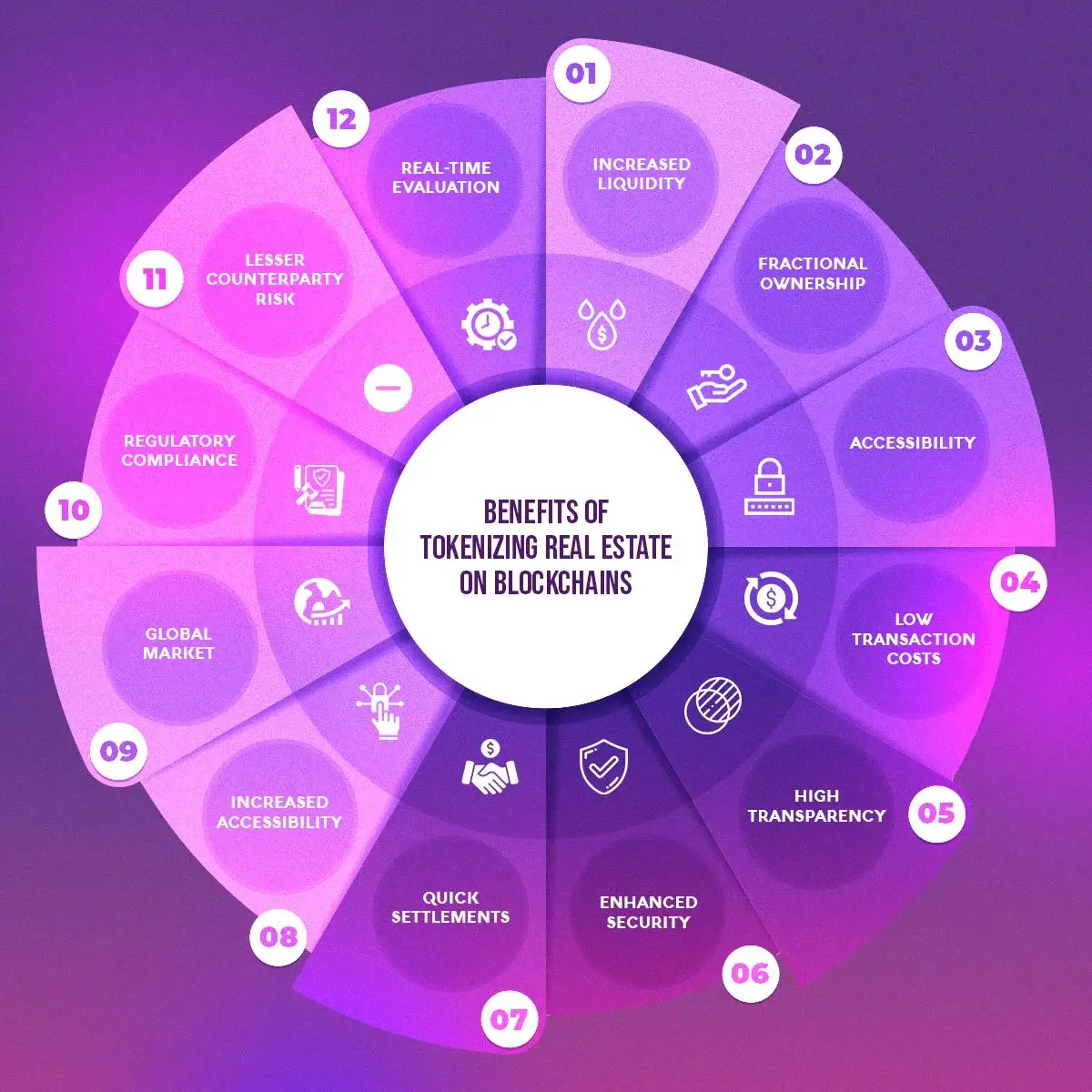

The advantages driving adoption of blockchain-based fractional ownership are clear:

- Accessibility: Minimum investments start at just $50 on platforms like Lofty AI.

- Liquidity: Property tokens can be traded instantly on secondary markets.

- Transparency and Security: Blockchain ledgers provide immutable records and reduce fraud risk.

- Global Reach: Investors from different jurisdictions can participate seamlessly.

This new model also streamlines income distribution through smart contracts – for instance, RealT delivers daily rental payments directly in stablecoins to token holders. Such innovations underscore why institutional players and everyday investors alike are embracing this new era in real estate investing.

As more platforms enter the space, competition is driving greater efficiency, compliance, and user-centric features. For example, Propy integrates end-to-end KYC and legal compliance directly into its platform, while Lofty AI leverages advanced analytics to help users select properties with optimal risk-return profiles. These enhancements are not just technical upgrades, they are critical enablers for mainstream adoption, ensuring that tokenized assets can be accessed safely and easily by a diverse investor base.

Regulatory clarity is also emerging as a key factor in the growth of global real estate access via tokenization. Dubai’s government-backed initiatives provide a blueprint for secure, cross-border transactions, while U. S. -based projects operate under SEC oversight to protect investors. This dual trend of innovation and regulation is fostering trust in property tokens as a legitimate asset class, one that is increasingly recognized by both institutional and retail investors.

Key Considerations: Risks, Challenges, and What to Watch

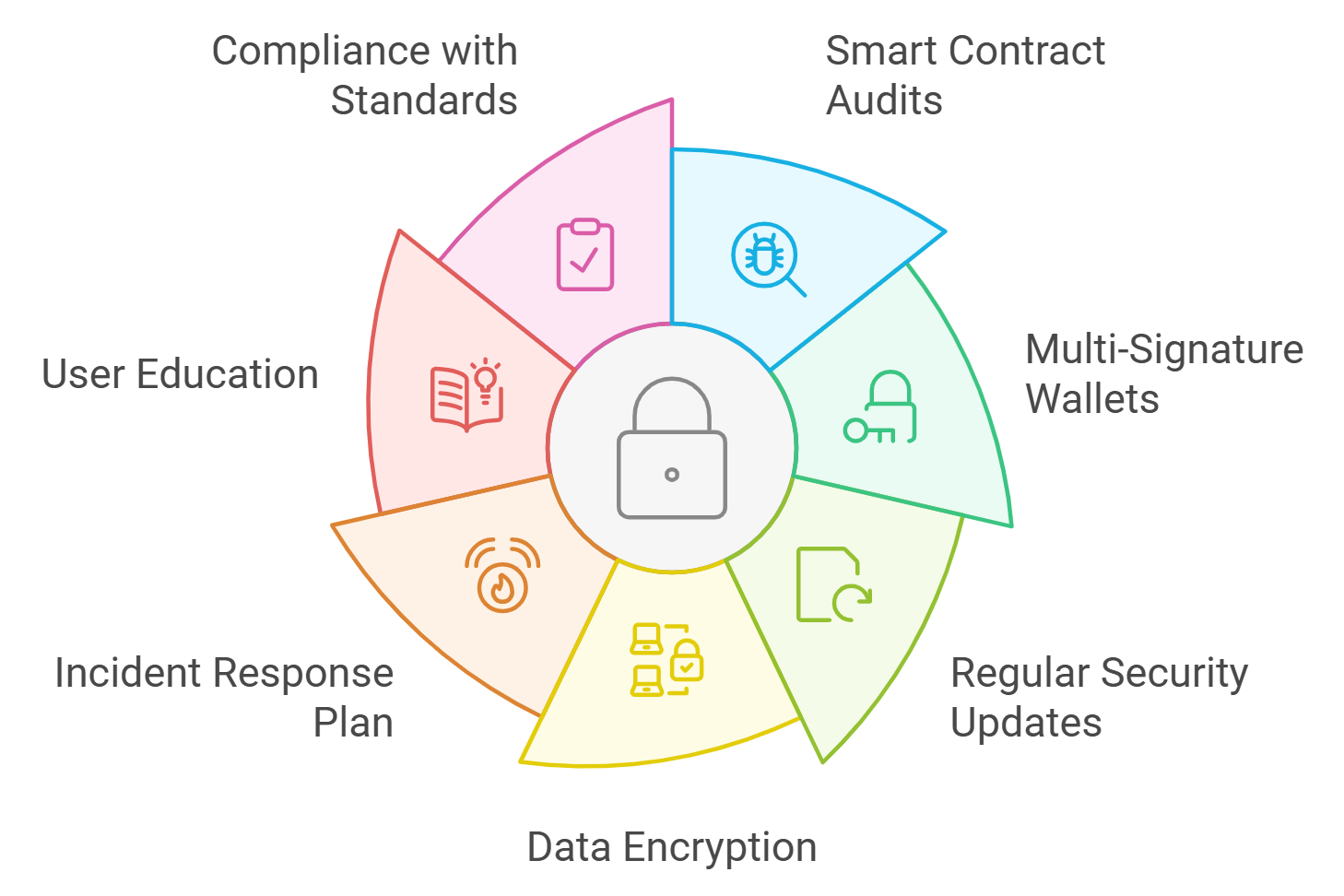

Despite its promise, fractional real estate ownership via blockchain does come with caveats. Regulatory frameworks remain fragmented across jurisdictions, meaning investors must perform due diligence on platform compliance. Smart contract security is another vital concern; vulnerabilities or coding errors can expose holders to losses or operational disruptions.

Market liquidity, while improving rapidly thanks to secondary trading venues, is not yet on par with traditional equities or cryptocurrencies. Investors should be aware that selling property tokens may still involve waiting periods or price volatility depending on demand for specific assets. Additionally, tax treatment of tokenized property income varies by country and can impact net returns.

Top Risks & Mitigation Strategies in Tokenized Real Estate

-

Regulatory Uncertainty: Laws governing tokenized real estate vary by jurisdiction and are rapidly evolving. This can impact the legality and transferability of tokens, especially for cross-border investors.Mitigation: Invest through platforms like Propy or RealT that operate under clear regulatory frameworks and offer built-in KYC/AML compliance.

-

Liquidity Constraints: While tokenized assets are more liquid than traditional real estate, secondary markets may still lack sufficient buyers or sellers, especially in downturns.Mitigation: Use platforms with active secondary markets, like RealT, and diversify across multiple properties and regions to reduce liquidity risk.

-

Property Management & Income Reliability: Returns depend on effective property management and consistent rental income, which can be disrupted by vacancies or operational issues.Mitigation: Select platforms like Lofty AI that leverage AI analytics for property selection and automate income distribution via smart contracts.

-

Platform Risk: Centralized tokenization platforms may face operational failures, hacks, or insolvency, potentially affecting investor access to assets or funds.Mitigation: Prioritize established, well-capitalized platforms such as Propy and RealT with transparent operational histories and robust security protocols.

For those considering entry into this market, it’s essential to select platforms with strong track records in compliance, security auditing, and transparent reporting. Reviewing smart contract code audits and understanding local regulations should be standard practice before allocating capital.

The Road Ahead: Scaling Up Global Property Investment

The future of blockchain property investment looks increasingly borderless and democratized. As tokenization platforms refine their technology stacks and regulatory bodies provide clearer frameworks, we can expect even broader participation, from first-time investors in emerging markets to large-scale institutions seeking global diversification.

This trend will likely accelerate as interoperability between blockchains improves and as more traditional real estate firms begin offering tokenized shares of their portfolios. The result? A more liquid, transparent global property market where anyone can participate in the upside of real estate appreciation, without the friction of legacy systems or geographic boundaries.

If you’re ready to explore how these innovations are lowering barriers worldwide, dive deeper at How Fractional Real Estate Tokenization Lowers Investment Barriers for Global Investors.