How Fractional Real Estate Tokenization Lowers Investment Barriers for Global Investors

Fractional real estate tokenization is rapidly transforming the landscape of property investment. By leveraging blockchain technology, this model allows investors worldwide to purchase small, tradable shares of real estate, breaking down barriers that have historically limited access to high-value assets. As of mid-2025, more than $7 billion worth of property has been tokenized, with over 1.2 million global investors actively participating in this new market segment (Source: Medium · Blockchain App Factory). The implications are profound: real estate is no longer the exclusive domain of institutions or ultra-high-net-worth individuals.

Lowering Capital Requirements: Real Estate Investment for $50

One of the most significant advantages of fractional real estate tokenization is dramatically reduced capital requirements. Platforms like RealT and Lofty have pioneered the ability for users to invest in U. S. rental properties starting at just $50 per token. This democratizes access, enabling participation from a much broader spectrum of investors, including those who may have previously found traditional property ownership financially out of reach.

The low entry point is not just a marketing gimmick; it fundamentally shifts how individuals interact with real estate markets. By purchasing tokens that represent fractional ownership, investors can diversify across multiple properties and geographies without tying up large sums in a single asset. According to

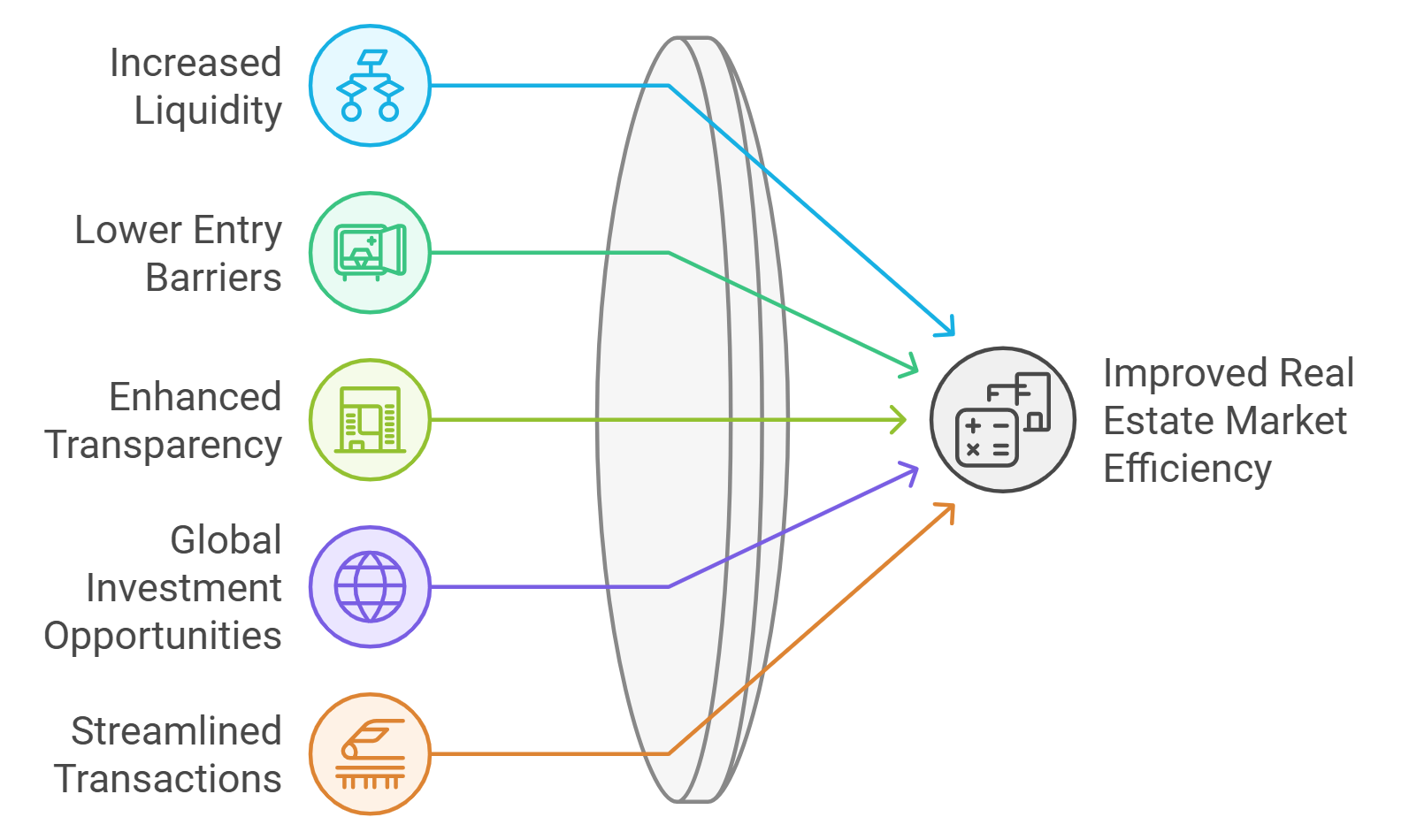

Key Benefits of Fractional Real Estate Tokenization

-

Global Accessibility: Tokenization enables investors worldwide to access and invest in international real estate markets without the traditional hurdles of cross-border transactions.

-

Enhanced Liquidity: Tokenized real estate assets can be traded on secondary markets, giving investors the flexibility to buy and sell property shares more easily than with traditional real estate investments.

-

Diversification Opportunities: Investors can diversify their portfolios by owning fractions of multiple properties across different locations and asset types, reducing risk and increasing potential returns.

-

Increased Transparency & Security: Blockchain technology ensures every transaction is recorded on an immutable ledger, enhancing transparency and reducing fraud risk for global investors.

Global Market Access and Enhanced Liquidity

Blockchain-based property tokens are borderless by design. Tokenization eliminates many logistical and regulatory hurdles associated with cross-border transactions, allowing anyone with an internet connection and compliant wallet to invest in properties located anywhere in the world. This has opened U. S. , European, and Asian markets to a truly global investor base, an unprecedented level of accessibility.

The liquidity profile of real estate has also undergone a radical improvement thanks to secondary markets for property tokens. Unlike traditional property investments, which can take months or years to liquidate, tokenized assets can be traded 24/7 on compliant exchanges or peer-to-peer platforms. While some concerns remain about trading volumes on certain assets (see current research here), the overall trend points toward increasing fluidity and flexibility for investors seeking both entry and exit opportunities.

Transparency, Security, and Trust via Blockchain

The use of blockchain technology brings an unprecedented level of transparency and security to real estate investing. Every transaction, whether it’s an initial purchase or a secondary trade, is immutably recorded on-chain. This not only reduces fraud risk but also simplifies tracking ownership history and income distributions over time (read more about transparency here). For global investors wary of opaque intermediaries or unfamiliar legal systems, blockchain provides an auditable source of truth that builds trust across borders.

Despite these breakthroughs, fractional real estate tokenization is not without its complexities. Regulatory frameworks remain inconsistent across jurisdictions, which can introduce legal uncertainty for both platforms and investors. While some countries are moving swiftly to clarify the status of property tokens, others lag behind, creating a patchwork that requires careful navigation. Investors must ensure their chosen platform adheres to all relevant compliance standards and conducts rigorous due diligence on listed assets. For further insights into legal considerations, see the overview at Dentons.

Technological risk is another factor to weigh. Blockchain and smart contracts offer powerful security features but are not immune to bugs or exploits. Leading platforms invest heavily in code audits and ongoing security measures, but as with any digital asset, vigilance is required from both providers and investors. Understanding wallet management, private key security, and platform-specific risks is vital for anyone entering this space.

Who Benefits Most from Accessible Tokenized Real Estate?

The impact of fractional real estate tokenization extends well beyond individual retail investors. Small family offices, independent advisors, and even institutional players are increasingly exploring tokenized property as a means of portfolio diversification and yield generation. For those in emerging markets or regions with capital controls, property tokens present a rare opportunity to gain exposure to stable international assets, often with lower transaction costs than traditional routes.

This shift also empowers property owners and developers by unlocking new pools of global capital. By selling fractional interests rather than entire buildings or units, they can raise funds more efficiently while maintaining operational control over their assets.

The Future: Toward Greater Liquidity and Global Reach

The pace of adoption suggests that tokenized property ownership will become a core feature of global real estate markets within the next decade. According to Deloitte Insights, the market for tokenized real estate could expand dramatically by 2035 as regulatory clarity improves and secondary trading volumes increase. The ability to invest in prime commercial buildings or high-demand rental properties for just $50 per token is already reshaping investor expectations (see more here).

As platforms continue to innovate, integrating features like automated income distribution, instant settlement, and AI-driven property selection, the friction traditionally associated with real estate investing will continue to fall away.

The bottom line: Fractional real estate tokenization is making once-unattainable markets accessible to millions worldwide by lowering entry barriers to as little as $50. The technology’s promise lies in its combination of transparency, liquidity, and truly global access, though it still demands thoughtful risk management from participants at every level.