How Real Estate Tokenization Is Making Prime Dubai Properties Globally Accessible

Dubai’s skyline has long symbolized ambition, but in 2025, it’s the emirate’s digital innovation that’s catching global attention. Through real estate tokenization, Dubai is transforming the way investors worldwide access its most prestigious properties. This isn’t just about new tech buzzwords; it’s about breaking down the barriers that once made prime Dubai real estate the exclusive playground of the ultra-wealthy. Now, with blockchain-powered fractional ownership, nearly anyone can own a piece of Dubai’s luxury property market, no matter where they live.

Dubai’s Government: Driving the Tokenization Revolution

At the heart of this transformation is a bold government strategy. In March 2025, the Dubai Land Department (DLD) launched an industry-first pilot program to tokenize property title deeds on blockchain. This move, developed in partnership with the Virtual Assets Regulatory Authority (VARA) and the Dubai Future Foundation (DFF), marks a pivotal leap toward Dubai’s 2033 vision: a real estate market where 7% of all transactions: worth a projected $16 billion, are conducted via tokenized assets.

The DLD and VARA agreement to directly link Dubai’s real estate registry with property tokenization isn’t just a regulatory milestone, it’s a signal to global investors that Dubai is serious about transparency, security, and accessibility. By synchronizing tokenized assets with official records, Dubai is making it easier for investors across continents to trust and participate in its property market.

Private Sector Partnerships: Mega-Deals and Global Access

The private sector is matching the government’s ambition step for step. In January 2025, DAMAC Group inked a $1 billion deal with blockchain platform MANTRA to tokenize its Middle Eastern assets. This isn’t theoretical, the partnership enables investors to buy and trade fractional shares of DAMAC’s real estate portfolio online, opening doors that were previously shut to all but the largest players.

And it doesn’t stop there. In May, developer MAG joined forces with MultiBank and Mavryk in a $3 billion agreement to tokenize luxury properties like The Ritz-Carlton Residences and Keturah Reserve. These high-profile assets are now accessible as digital tokens, available for purchase through MultiBank. io. For global investors, this means that buying into Dubai’s most coveted addresses is as simple as a few clicks.

3 Key Benefits of Tokenized Dubai Real Estate

-

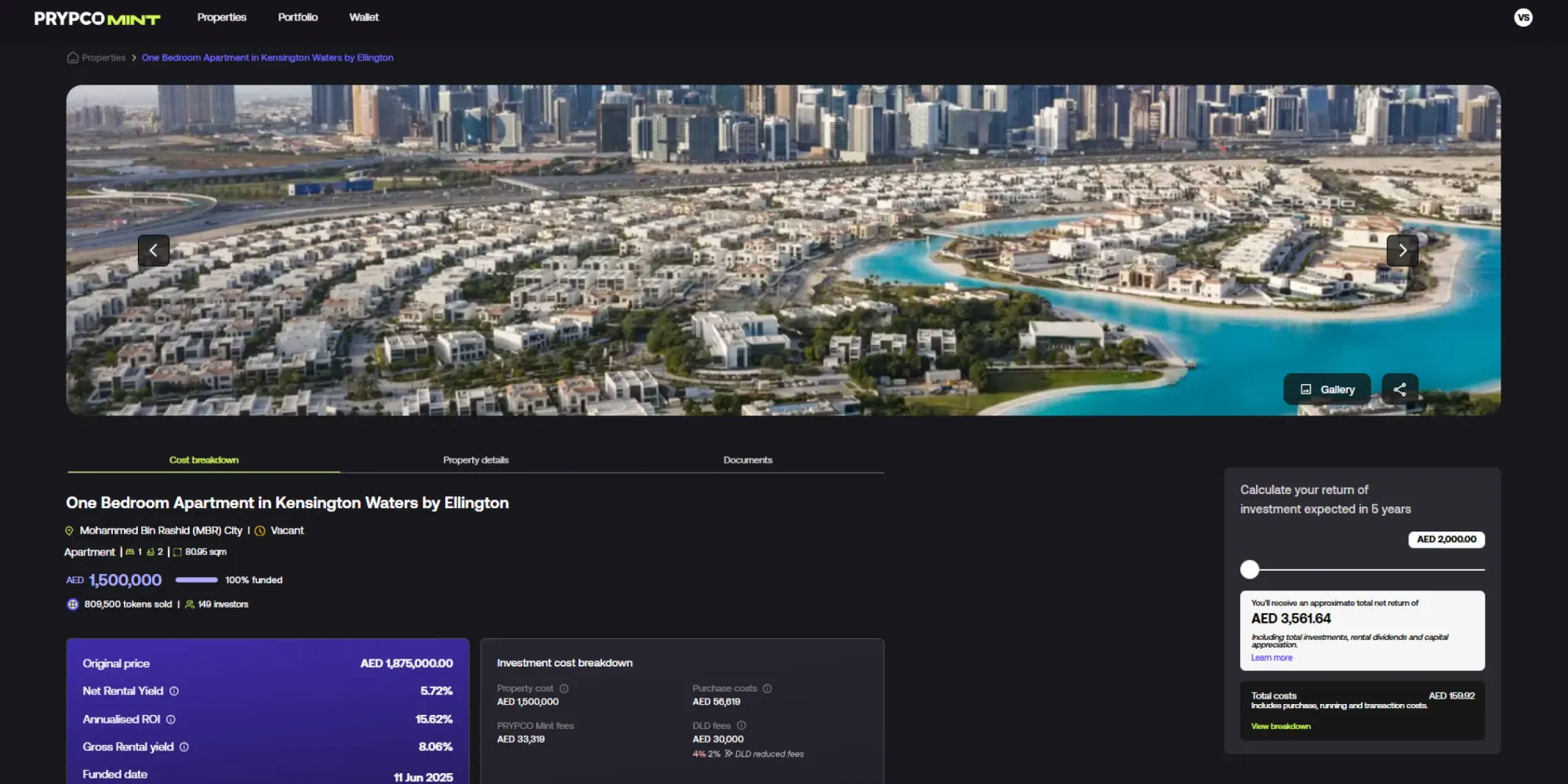

Global Accessibility & Fractional Ownership: Tokenization allows investors worldwide to buy fractional shares of prime Dubai properties, breaking down traditional barriers like high capital requirements and complex paperwork. Platforms such as Prypco Mint enable easy entry, letting you invest from anywhere without needing to physically visit Dubai.

-

Enhanced Liquidity & Flexible Trading: Unlike conventional real estate, tokenized assets can be traded on digital marketplaces, making it easier to buy or sell property shares. Dubai’s partnerships with platforms like MANTRA and MultiBank.io mean investors can access secondary markets, boosting liquidity and offering more flexible exit options.

-

Regulatory Confidence & Market Growth: Dubai’s government, through the Dubai Land Department (DLD) and Virtual Assets Regulatory Authority (VARA), has established clear frameworks and pilot programs for tokenized real estate. This proactive approach ensures investor protection and positions Dubai as a leader in the global property tokenization market, projected to reach $16 billion by 2033.

How Fractional Ownership Lowers Barriers

Traditional real estate investment in Dubai often meant significant upfront capital, complex legal processes, and lengthy paperwork, especially for non-residents. Tokenization flips this script. By converting property rights into digital tokens on a blockchain, it enables fractional property ownership. Investors can now buy small shares in high-value assets, diversifying portfolios without overextending themselves.

The DLD’s Prypco Mint platform is a prime example. Developed with fintech firm Prypco and leveraging the XRP Ledger, it allows users to purchase fractions of Dubai properties using local currency, with title deeds securely recorded on-chain. While initially limited to UAE ID holders, plans are underway to open it up for global participation, a move that could further democratize access and liquidity.

Setting a Global Standard for Blockchain Real Estate

Dubai’s rapid adoption of real estate tokenization is sending ripples through markets worldwide. With a projected on-chain value of $17 billion in tokenized real-world assets associated with the UAE as of 2025, the emirate is proving that regulatory clarity, strong tech infrastructure, and public-private collaboration can turn ambitious visions into investable realities. For those exploring global property investment, fractional property ownership Dubai, or simply seeking more accessible ways to diversify with tokenized property Dubai, this moment marks a fundamental shift.

Dubai’s model isn’t just about opening the door, it’s about removing it entirely. International investors, from seasoned asset managers to first-time buyers, are now participating in a market once defined by exclusivity. The numbers speak volumes: the first project under the Real Estate Tokenization Initiative drew 224 investors, with 70% entering Dubai’s real estate sector for the first time. This is proof that tokenization is not just a buzzword but a working solution for accessible real estate investment.

What makes this so compelling? For one, tokenized assets can be bought and sold in real time on compliant platforms, bypassing traditional hurdles like travel, language barriers, or complex paperwork. With regulatory frameworks now firmly in place, thanks to DLD and VARA, investors enjoy enhanced security and transparency. Plus, blockchain records are immutable and auditable, providing peace of mind for those wary of international property markets.

Looking Ahead: The Future of Tokenized Property in Dubai

As more prime assets move on-chain and platforms like Prypco Mint prepare for global rollout, we’re seeing the emergence of a new asset class: liquid real estate. Unlike traditional bricks-and-mortar holdings that can take months to buy or sell, tokenized shares can be traded instantly, bringing much-needed liquidity to a historically illiquid market.

“Tokenization is allowing us to invest in Dubai properties as easily as we invest in stocks or crypto, this is game-changing. “

The ripple effects go beyond individual investors. Developers gain access to new funding streams by selling fractional shares before project completion. Local economies benefit from increased foreign capital inflows. Meanwhile, Dubai cements its reputation as a forward-thinking hub where innovation meets opportunity.

Key Takeaways for Investors Eyeing Dubai

Top 5 Tips for Safe & Profitable Tokenized Dubai Real Estate Investing

-

Verify Regulatory Compliance with DLD & VARABefore investing, ensure the tokenized property platform is officially registered with the Dubai Land Department (DLD) and regulated by the Virtual Assets Regulatory Authority (VARA). This guarantees your investment aligns with Dubai’s legal framework and benefits from government-backed protections.

-

Choose Established Platforms Like Prypco Mint or MultiBank.ioOpt for reputable, government-endorsed platforms such as Prypco Mint (integrated with the DLD and XRP Ledger) or MultiBank.io (partnered with MAG and Mavryk). These platforms offer secure access to tokenized prime Dubai properties and synchronize with official property records.

-

Understand Fractional Ownership and LiquidityTokenization allows you to buy small fractions of high-value properties. Research how easily you can trade or sell your tokens on secondary markets, and check if the platform provides transparent information on liquidity and exit options.

-

Assess Property Quality and Developer ReputationFocus on properties from renowned developers like DAMAC Group and MAG, whose assets are now being tokenized. Review the property’s location, amenities, and track record of the developer to ensure long-term value.

-

Stay Informed About Fees, Taxes, and Local RulesTokenized real estate may involve platform fees, transaction charges, and Dubai-specific taxes. Always review the fee structure, understand your tax obligations as a foreign investor, and monitor updates from DLD and VARA for regulatory changes.

If you’re considering diversifying into blockchain real estate Dubai, start by researching platforms with strong compliance records and transparent governance structures. Look for projects that synchronize with official registries, like those backed by DLD, to ensure your tokens represent true legal ownership. And stay updated on regulatory changes; Dubai’s proactive stance means rules evolve quickly but always in favor of making investment more secure and accessible.

The bottom line? Prime Dubai properties are no longer reserved for an elite few. Through tokenization, they’re becoming part of portfolios from New York to Nairobi, and everywhere in between. If you want to dive deeper into how these digital innovations are unlocking global property investing, check out this detailed resource: How Dubai’s Tokenized Real Estate Sales Are Unlocking Global Property Investing.