How Property Tokenization is Transforming Commercial Real Estate Investing in 2024

In 2024, the commercial real estate sector underwent a profound transformation as property tokenization moved from theory to large-scale implementation. By converting physical assets into digital tokens on blockchain platforms, commercial properties became accessible to a broader range of investors. This shift was not just technological but fundamentally economic, breaking down traditional barriers and introducing new liquidity dynamics to an asset class long considered illiquid and exclusive.

From Illiquid Asset to Tradable Token: The New Commercial Real Estate Paradigm

Historically, commercial real estate (CRE) investments demanded significant capital, lengthy transaction cycles, and often years-long lock-in periods. In 2024, tokenization rapidly changed that landscape. According to Deloitte Insights, the global market for tokenized real estate stood at under $300 billion in 2024 but is projected to reach $4 trillion by 2035. This staggering growth reflects a compound annual growth rate (CAGR) of 27% – a testament to how quickly fractional ownership and secondary trading are being adopted by both institutional and retail investors.

The core mechanism is straightforward yet revolutionary: each property is divided into digital shares or tokens, which are then sold on blockchain-powered platforms. Investors can now buy fractions of office towers or logistics parks as easily as purchasing stocks – with minimum investments often reduced from millions to just hundreds of dollars.

The Mechanics Behind Fractional Ownership and Blockchain Liquidity

Tokenized commercial property investment leverages smart contracts and distributed ledgers for transparency, efficiency, and security. Each token represents a share in the underlying asset’s cash flow and appreciation potential. Through these mechanisms, investors gain exposure to rental yields and capital gains while enjoying the flexibility of trading their holdings on secondary markets.

Consider the case of APS’s €3 million investment in tokenized bonds tied to Rome residential properties via MetaWealth – an early sign that institutional capital is embracing this model (Tokenizer Estate). Meanwhile, Asian developers like Seazen Group are exploring large-scale asset digitization through dedicated digital asset institutes (Reuters), signaling global momentum beyond Western markets.

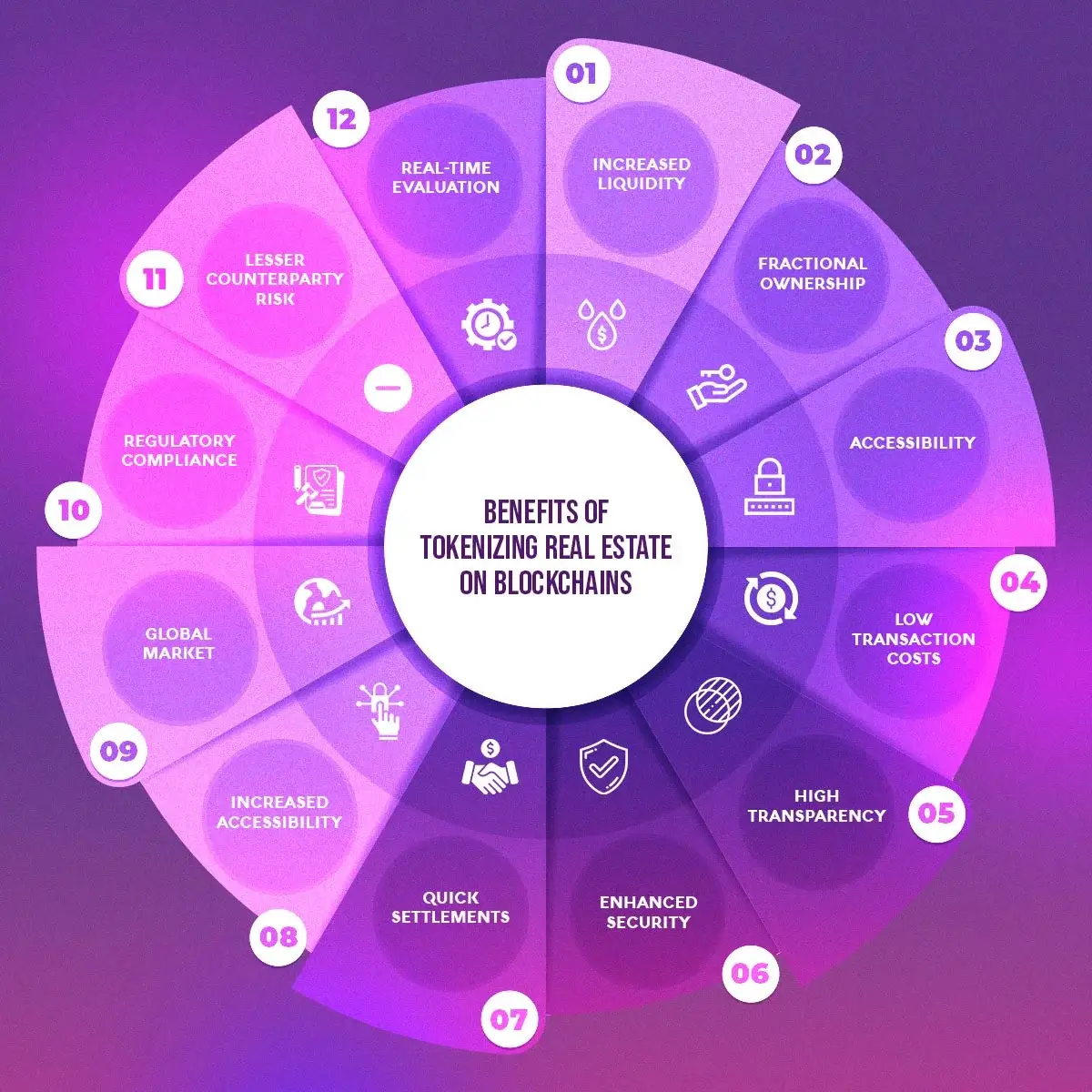

Key Benefits of Commercial Real Estate Tokenization in 2024

-

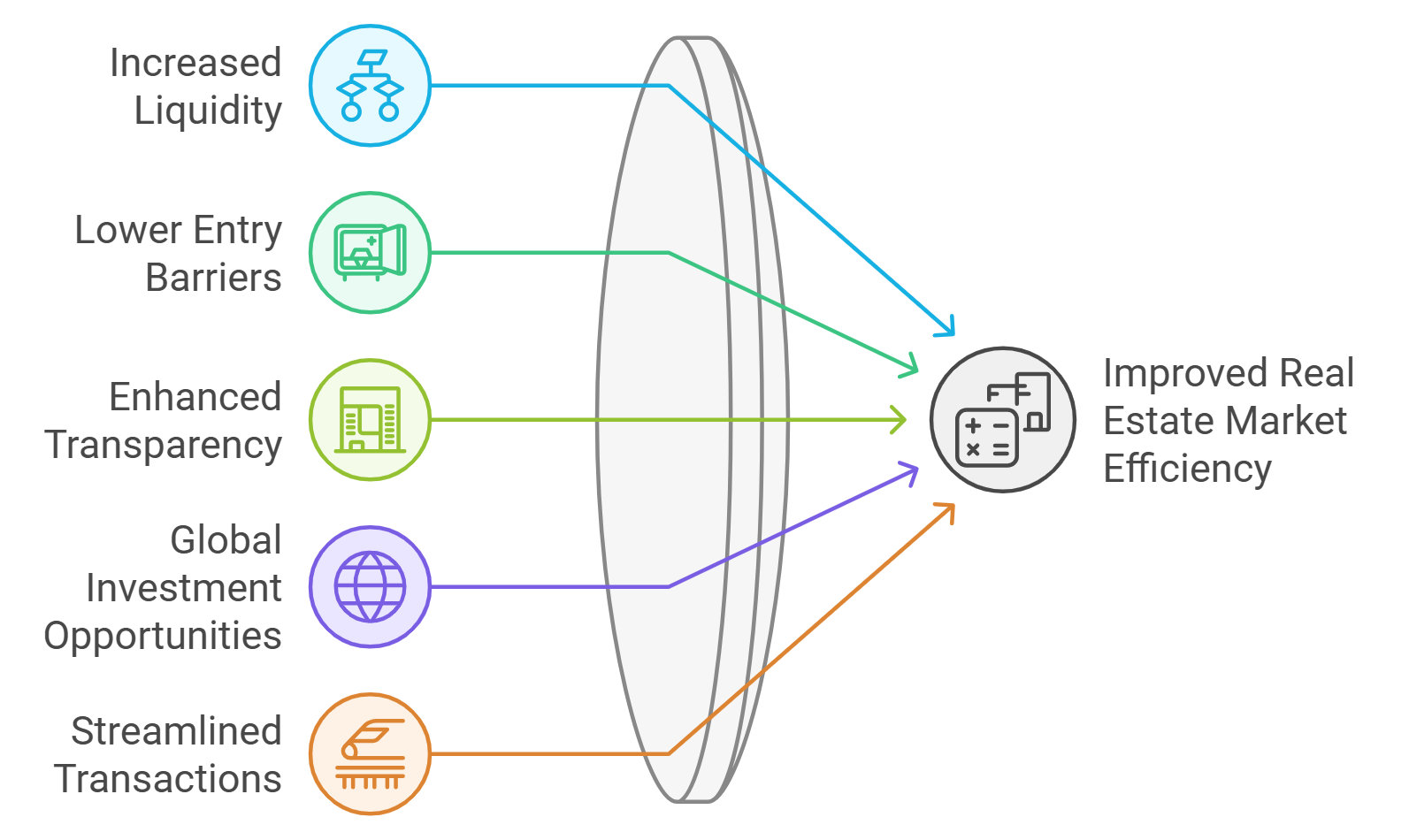

Fractional Ownership and Lower Barriers to Entry: Tokenization enables investors to purchase small fractions of high-value commercial properties, making real estate investment more accessible and democratized than ever before.

-

Enhanced Liquidity Through Secondary Markets: Investors can trade property tokens on digital exchanges, offering faster and more flexible exit options compared to traditional real estate investments, which are typically illiquid.

-

Global Reach and Diversification: Blockchain-based tokenization platforms allow investors worldwide to access and diversify across commercial real estate assets in multiple regions without geographical constraints.

-

Increased Transparency and Security: Blockchain technology ensures transparent transaction histories, immutable records, and enhanced security, reducing fraud and improving trust among investors.

-

Institutional Adoption and Market Growth: Leading institutional investors, such as APS and Seazen Group, are entering the tokenized real estate market, signaling growing confidence and driving projected market expansion from under $300 billion in 2024 to over $4 trillion by 2035 (Deloitte).

Market Data: Adoption Accelerates Amid Infrastructure Challenges

The numbers tell a compelling story: as of mid-2024, approximately 12% of real estate companies worldwide had implemented some form of tokenization, with another 46% running pilots or planning integration (Deloitte Insights). However, while secondary market trading improved liquidity on paper, actual trading volumes remained modest for most real-world asset (RWA) tokens. This gap highlights ongoing challenges around investor education, regulatory clarity, and platform interoperability.

Despite these hurdles, the direction is clear: property tokenization is not just an incremental improvement but a wholesale reinvention of how capital flows into CRE. The groundwork laid in 2024 will shape a more accessible and liquid market for years ahead.

Looking ahead, the strategic implications for investors and property owners are significant. Tokenized commercial property investment is rapidly becoming a core pillar of diversified portfolios, especially as macroeconomic volatility and inflation concerns drive demand for alternative assets. By enabling fractional ownership on blockchain real estate platforms, tokenization bridges the gap between traditional real estate and the new wave of digital finance.

Yet, it’s important to recognize that this transformation is not without growing pains. Regulatory frameworks are still catching up to innovation, with jurisdictions worldwide working to clarify compliance standards for real estate RWA protocols. Market infrastructure is evolving, but low trading volumes on many tokenized assets underscore the need for deeper liquidity pools and broader investor participation. As highlighted in recent research (arxiv.org), these are not insurmountable obstacles, rather, they represent the next phase of maturation for the sector.

What’s Next for Commercial Real Estate Tokenization?

The market trajectory remains bullish: Deloitte projects that by 2035, $4 trillion of real estate will be tokenized, up from less than $300 billion in 2024. The pace of adoption will depend on several factors:

Key Drivers of CRE Tokenization Through 2025

-

Institutional Adoption Accelerates: Major players like APS and Seazen Group are entering the tokenized real estate space, with APS investing €3 million in tokenized bonds via MetaWealth and Seazen Group launching the Seazen Digital Assets Institute in Hong Kong.

-

Fractional Ownership Lowers Barriers: Blockchain-based tokenization enables investors to purchase fractional shares of high-value commercial properties, democratizing access and broadening the investor base.

-

Enhanced Liquidity via Secondary Markets: Token holders can trade their property shares on regulated secondary marketplaces, offering faster and more flexible exits compared to traditional real estate investments.

-

Rapid Market Growth and Projections: The global tokenized real estate market is projected to expand from under $300 billion in 2024 to over $4 trillion by 2035, reflecting a 27% CAGR, according to Deloitte Insights.

-

Regulatory and Infrastructure Evolution: Ongoing development of legal frameworks and trading infrastructure is addressing challenges such as low trading volumes and limited investor participation, paving the way for mainstream adoption.

For forward-thinking investors, early engagement offers a distinct advantage. Not only does it provide access to previously out-of-reach assets, but it also enables portfolio rebalancing with unprecedented speed and efficiency. The ability to trade property tokens in near real time means capital can flow where it’s needed most, unlocking value across global markets.

“Tokenization is not just digitizing ownership, it’s democratizing opportunity. “

The convergence of blockchain technology and commercial real estate is already attracting attention from both institutional giants and agile startups. Platforms specializing in tokenized commercial property investment are racing to build compliant, user-friendly marketplaces that cater to a new generation of investors hungry for transparency, liquidity, and global reach.

Key Takeaways for 2024 Investors

- Liquidity is improving, but due diligence on platform volume and regulatory compliance remains essential.

- Fractional ownership lowers barriers, making high-value CRE accessible to retail investors worldwide.

- Market growth is exponential: With projections at $4 trillion by 2035, early adopters stand to benefit most from this paradigm shift.

- Regulatory clarity is coming: Expect evolving standards as governments respond to industry innovation.

The groundwork laid in 2024 has positioned commercial real estate tokenization as one of the most disruptive trends in global finance. For those willing to navigate its challenges, and seize its opportunities, the future looks distinctly digital and remarkably liquid.