The Impact of Tokenized Real Estate on Portfolio Diversification

Tokenized real estate is rapidly shifting the landscape for portfolio diversification, offering an unprecedented combination of accessibility, liquidity, and transparency. By converting fractional property ownership into digital tokens on a blockchain, investors are now able to participate in high-value property markets with far less capital than ever before. For example, a $10 million asset can be split into 1 million tokens at $10 each, opening doors for both seasoned investors and newcomers seeking exposure to real estate without the traditional barriers.

Fractional Ownership: Lowering Barriers and Expanding Reach

The primary innovation driving portfolio diversification with tokenized real estate is fractional ownership. Historically, direct real estate investment required significant capital outlays, often tying up funds in single properties or localized markets. Tokenization disrupts this model by enabling investors to spread their capital across numerous assets and geographies. This approach not only reduces concentration risk but also allows for strategic allocation based on sector trends or regional performance.

Consider an investor who previously needed hundreds of thousands of dollars to access prime commercial properties in global cities. With tokenization, that same investor can allocate modest sums across multiple property types – residential, commercial, industrial – and regions, all while maintaining flexibility to rebalance as market conditions evolve. This dynamic allocation was simply not feasible in the traditional real estate paradigm.

Liquidity: Solving Real Estate’s Historic Illiquidity Problem

One of the most persistent challenges in real estate investment has been illiquidity. Properties are typically slow to transact and involve complex legal processes. Tokenized assets address this by enabling secondary market trading of property tokens, offering near-instant liquidity compared to conventional sales cycles that can stretch for months.

This liquidity unlocks new risk management strategies for investors. Instead of being locked into long-term positions or weathering local downturns without recourse, token holders can quickly adjust their holdings in response to macroeconomic shifts or emerging opportunities. The ability to enter and exit positions efficiently is a foundational advantage for any diversified portfolio.

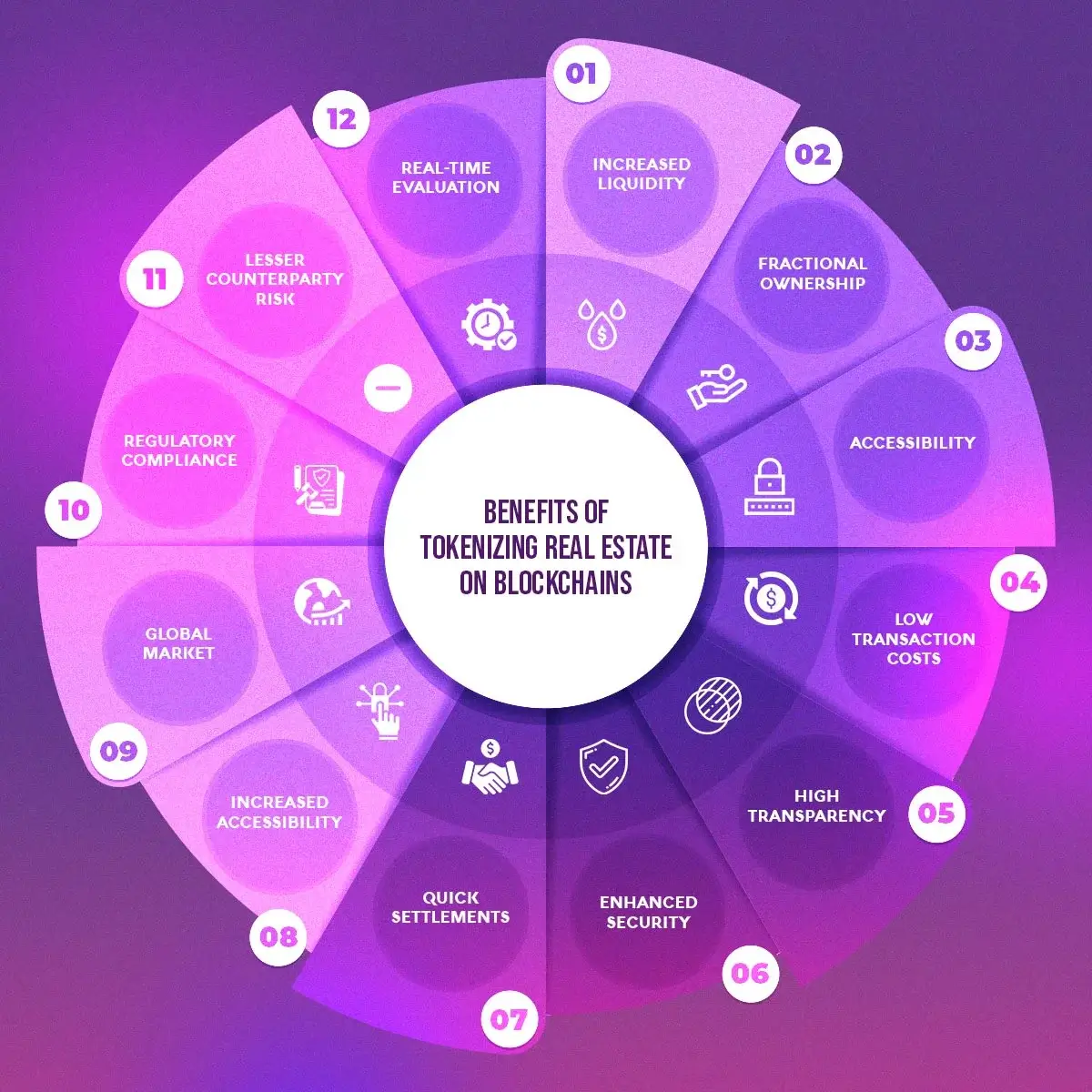

Key Benefits of Diversifying with Tokenized Real Estate

-

Lower Entry Barriers: Tokenization allows investors to purchase fractional ownership of properties, with tokens often available for as little as $10 each, making real estate accessible to a broader range of investors.

-

Enhanced Geographic Diversification: Investors can spread capital across multiple properties in different regions, reducing exposure to risks in any single market or location.

-

Improved Liquidity: Tokenized real estate assets can be traded on secondary markets, enabling quicker and more flexible portfolio adjustments compared to traditional property investments.

-

Increased Transparency and Security: Blockchain records each transaction and ownership change on an immutable ledger, reducing fraud risk and enhancing investor trust.

-

Automated Investment Management: Smart contracts handle processes such as income distribution and compliance, streamlining portfolio administration and reducing manual intervention.

Transparency and Security Through Blockchain

Blockchain technology underpins the security and transparency that make tokenized real estate viable at scale. Every transaction and ownership record is immutably logged on-chain, minimizing fraud risk and ensuring clear provenance for each property token. Smart contracts further automate compliance checks and income distributions, streamlining what were once labor-intensive processes.

This transparency fosters trust among a broader spectrum of investors – from institutional players constructing custom portfolios matched to their investment thesis (source: Deloitte Insights) to individuals seeking reliable alternative assets. The result is an ecosystem where due diligence is simplified, costs are reduced, and operational risks are mitigated at every stage.

Another significant advantage is the granularity of diversification now available to investors. With property tokens priced as low as $10, even modest portfolios can achieve meaningful exposure to multiple asset classes and regions. This stands in stark contrast to the high minimums and limited flexibility of traditional real estate funds or REITs. Investors can now hedge against sector-specific downturns or regional volatility by spreading their capital across a curated basket of tokens, each representing a stake in a unique property.

Liquidity also introduces new dynamics for portfolio rebalancing. In periods of heightened market uncertainty or emerging macroeconomic risks, token holders are not forced into binary decisions, such as selling an entire property or remaining exposed. Instead, they can sell portions of their holdings quickly and efficiently, freeing up capital for other opportunities or risk mitigation strategies. This flexibility is especially valuable in today’s fast-moving global markets.

Risks and Considerations for Tokenized Real Estate Diversification

While the benefits are compelling, it’s critical to approach tokenized real estate with a measured perspective. Regulatory frameworks remain uneven across jurisdictions; investors must conduct due diligence on the legal status and compliance protocols of each platform. Smart contract vulnerabilities, counterparty risks, and evolving tax treatment are all factors that require careful review before allocating significant capital to property tokens.

Furthermore, secondary market liquidity, while improved, can be inconsistent depending on platform adoption and asset type. Not all tokenized properties will attract equal demand, potentially leading to wider bid-ask spreads or periods of illiquidity. Investors should assess both the underlying asset quality and the trading infrastructure supporting their chosen tokens.

Strategic Takeaways for Modern Investors

For those seeking robust portfolio diversification with tokenized real estate, a disciplined approach is essential:

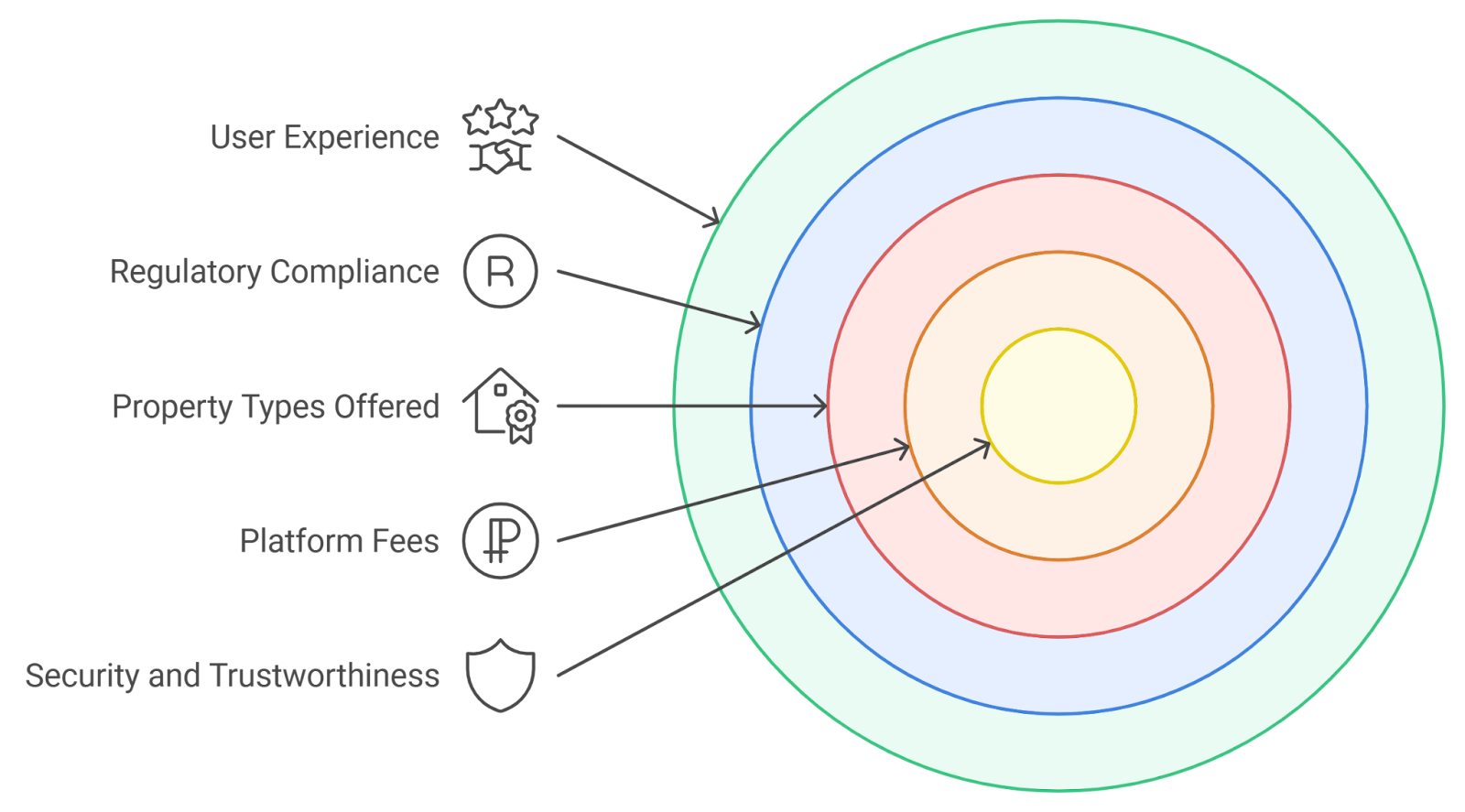

Best Practices for Evaluating Property Tokens

-

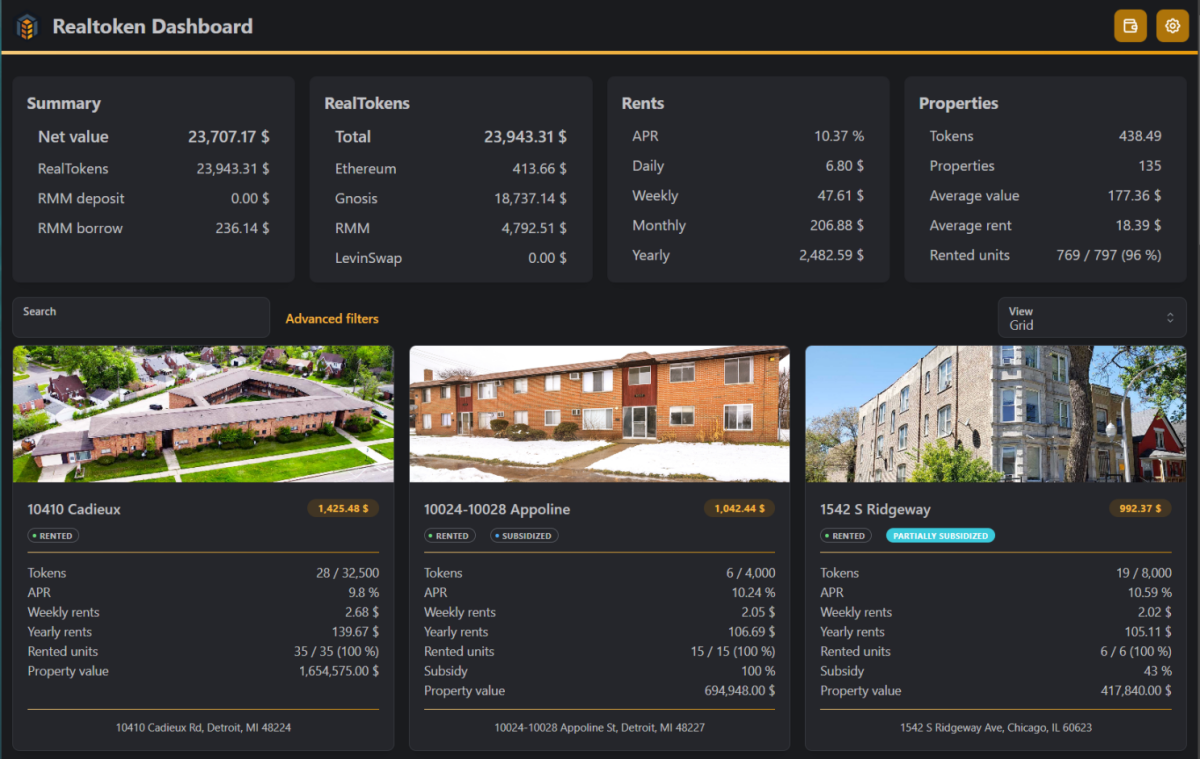

Conduct Thorough Due Diligence on Tokenization Platforms: Evaluate established platforms such as RealT, Lofty AI, and HoneyBricks for their regulatory compliance, track record, and security measures. Confirm that the platform uses reputable blockchain protocols and has transparent governance.

-

Assess Legal and Regulatory Compliance: Ensure the property tokens are issued in accordance with local and international securities laws. Look for platforms that provide clear documentation on legal structures, such as Regulation D or Regulation S offerings in the U.S.

-

Analyze Underlying Asset Quality and Valuation: Review detailed property information, including location, asset type, valuation reports, and historical performance. Platforms like Lofty AI and RealT offer transparent data on each tokenized asset.

-

Evaluate Liquidity and Secondary Market Access: Prefer tokens that are tradable on established secondary markets such as OpenSea (for select real estate NFTs) or native platform exchanges. Assess daily trading volumes and withdrawal policies to ensure sufficient liquidity.

-

Consider Portfolio Diversification Potential: Use tokenization to diversify across property types (residential, commercial, industrial) and geographies. Platforms like HoneyBricks and Lofty AI facilitate fractional investments in multiple markets, reducing concentration risk.

-

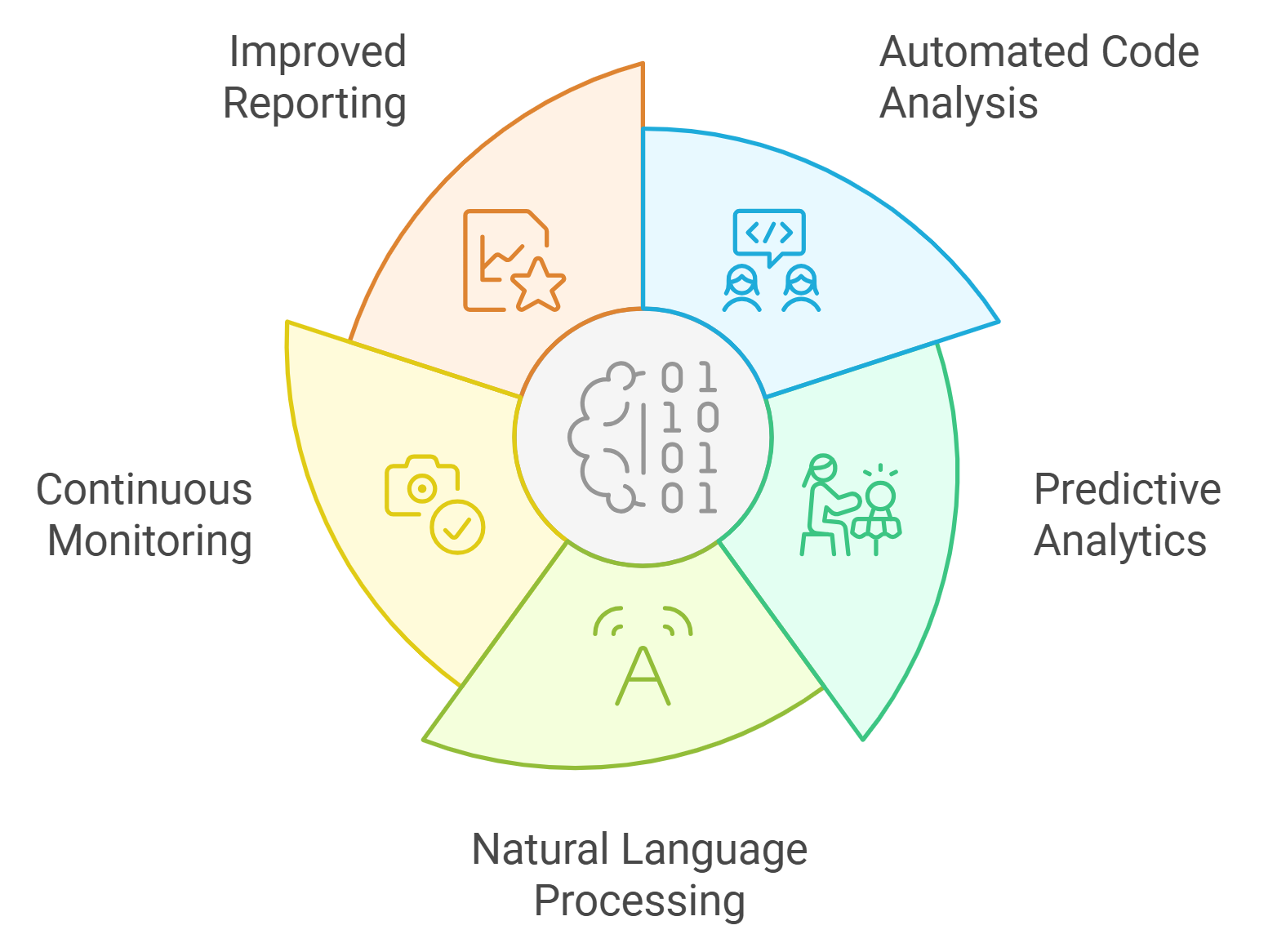

Review Smart Contract Security and Transparency: Examine the audit history of smart contracts managing the tokens. Look for third-party security audits and transparent, immutable transaction records on public blockchains such as Ethereum or Algorand.

-

Monitor Ongoing Performance and Reporting: Choose platforms that provide regular updates on property performance, income distributions, and token holder rights. Reliable reporting enhances transparency and supports informed decision-making.

Tokenization’s greatest strength lies in its ability to facilitate tailored risk profiles through fractional ownership, efficient liquidity management, and transparent recordkeeping. By carefully analyzing each opportunity, and understanding both its upside potential and inherent risks, investors can build resilient portfolios that respond dynamically to market shifts.

The landscape is still maturing; regulatory clarity will continue to evolve alongside technological innovation. Yet the core thesis remains sound: blockchain-powered property tokens offer access, liquidity, and transparency at an unprecedented scale (source: Primior). For forward-thinking investors willing to navigate these new waters methodically, tokenized real estate represents a powerful tool for achieving true diversification in a digital-first era.